The Zcash Breakout: What's Driving the Surge and Its Future Potential

I’ve spent my career watching technology unfold, from the sterile labs at MIT to the chaotic, brilliant world of crypto. I’ve seen code promise revolutions and then fizzle out. But every so often, you witness a moment that feels different—a moment that isn’t just about the technology itself, but about what it reveals about us and the world we’re building.

Last week was one of those moments.

The entire financial world, both crypto and traditional, held its breath as a single social media post from a former president sent markets into a freefall. We saw a staggering $20 billion in liquidations in the crypto space alone. It was a digital bloodbath, a stark reminder of how interconnected and fragile our systems have become. Bitcoin shuddered, Ether tumbled, and for a moment, it looked like everything was going down with the ship.

But then, something extraordinary happened. Amidst the sea of red, one asset didn't just find its footing; it soared. Zcash (ZEC), the privacy-focused coin, plummeted 45% with everything else, from $273 down to $150. And then, in less than 24 hours, it clawed back every single dollar and shot up to a new high of $291. While giants like Ether were still licking their wounds, down over 20%, the `Zcash price` chart showed how Zcash Shrugs Off Market Chaos to Hit New Highs.

So, what are we really looking at here? Is this just another speculative frenzy, or is it a signal of something far more profound?

The Signal in the Noise

When I saw the Zcash chart on Saturday morning, bouncing back while everything else was still bleeding red, I honestly just sat back in my chair. This wasn't just another altcoin pump. This was a statement. In a market driven by panic, something was driving a powerful, defiant demand for one specific thing: privacy.

On the surface, you can point to the technicals. Analysts will show you the beautiful "cup and handle" pattern that had been forming for months—a classic sign of buyers quietly accumulating, building pressure like a coiled spring. You can look at the MACD indicator giving a bullish signal for the first time in ages. But charts don't tell you the why. They're the shadow, not the object casting it.

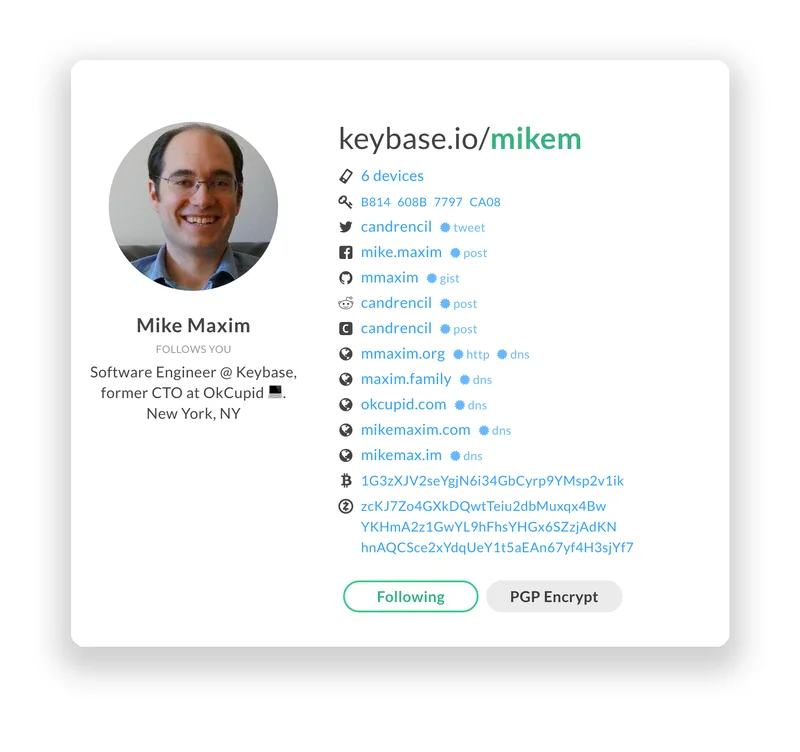

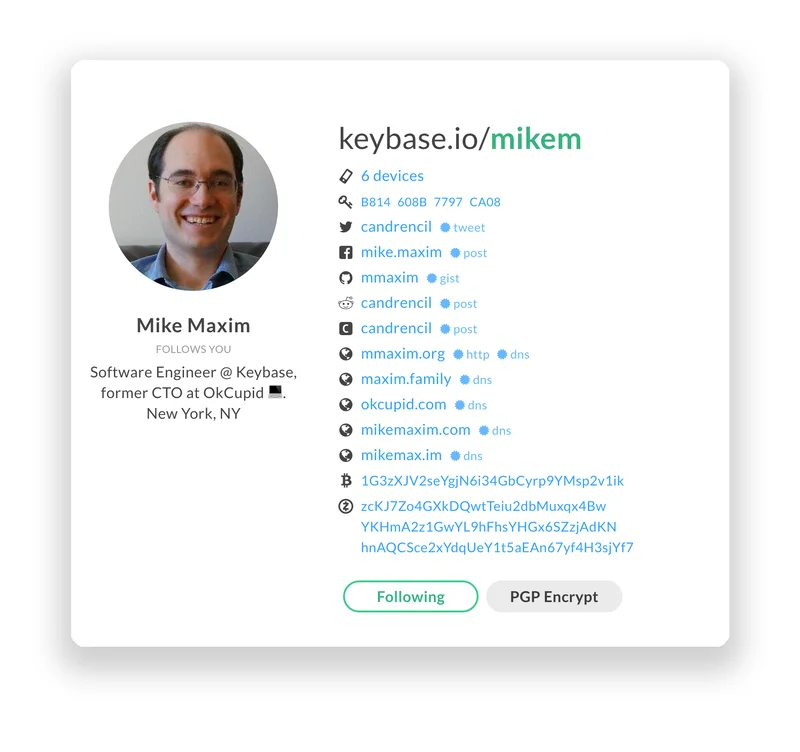

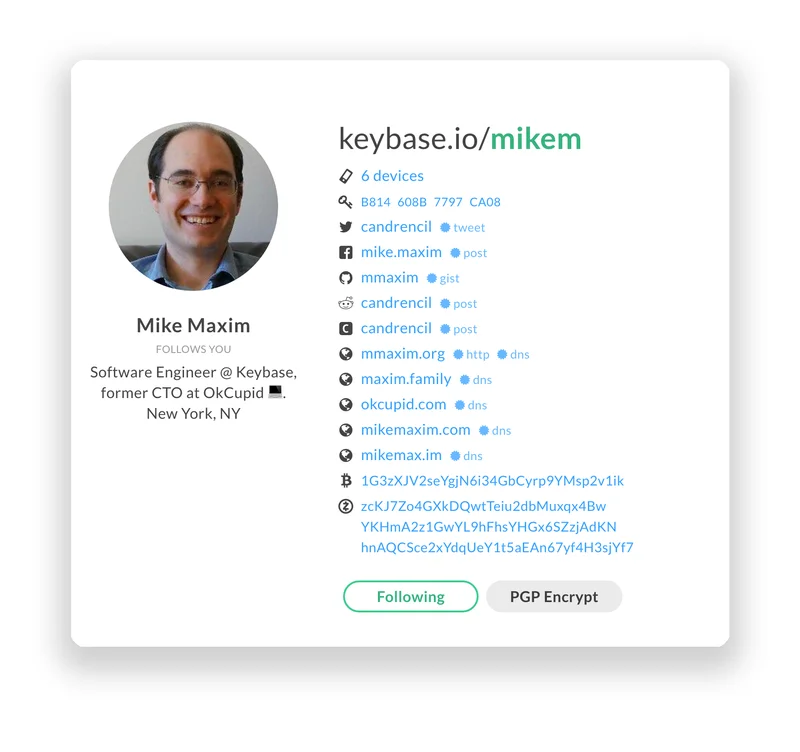

The real story is in the utility. Zcash’s rally was fueled by a confluence of factors that all point to genuine adoption. Grayscale reopening its Zcash Trust gave institutional players a regulated on-ramp. But more importantly, we saw a steady climb in shielded transaction volume. This uses something called zero-knowledge proofs—in simpler terms, it lets you prove you sent money without revealing who you are, who you sent it to, or how much you sent. It’s digital cash in its purest form. People weren't just trading `ZEC`; they were using it for its intended purpose.

They were choosing privacy in a world that suddenly felt terrifyingly volatile and exposed. What does it say when a geopolitical shockwave, triggered by a single person, sends the global economy into a tailspin, and the market’s immediate reflex is to buy an asset designed to be immune to that very system?

A Digital Lifeboat in a Geopolitical Storm

Let’s be clear: the market crash wasn’t a random event. It was a direct consequence of centralized power. The threat of tariffs, the cancellation of a diplomatic meeting—these are the levers of an old world order where a few individuals can upend the lives and fortunes of billions. And you start to see this isn't just about making money, it's about building a parallel system, one that doesn't shudder every time a politician fires off a tweet, a system where your value is yours and yours alone, shielded from the chaos of a world that feels increasingly unpredictable.

What we witnessed with Zcash was the digital equivalent of a ship with its own internal navigation system sailing through a hurricane that just knocked out all the lighthouses. While other assets were tossed around by the waves of political fear, Zcash’s value proposition—its core code of privacy and decentralization—acted as its anchor and its rudder.

This moment reminds me of the early days of the internet. Skeptics saw it as a tool for hobbyists and academics, failing to grasp that it was a fundamentally new protocol for information, one that would route around censorship and traditional gatekeepers. I believe we're seeing the same paradigm shift with value. Privacy coins like Zcash aren't just alternatives to Bitcoin; they represent a protocol for sovereign value.

Of course, with this kind of power comes immense responsibility. We have to build these tools with care, ensuring they empower individuals without enabling bad actors. It's a fine line, but one we must walk if we want to build a more resilient financial future. The question is no longer if we need these tools, but how we integrate them thoughtfully into our society.

The Quiet Revolution is Getting Louder

When you zoom out, the story of Zcash’s shock recovery is about more than just a `Zcash price prediction` or a temporary market trend. It’s a powerful vote of confidence in an idea—the idea that in an unstable world, privacy is not a feature; it’s a necessity. It’s a flight to safety, but the definition of "safety" is changing. It’s no longer just about gold or government bonds. It's about censorship-resistant, politically-agnostic, and truly personal value.

This wasn't just a coin bouncing back. This was the market sending a clear, unambiguous message. In the face of chaos, the demand for financial sovereignty isn't just surviving; it's thriving. And that’s a signal that’s impossible to ignore.