Zcash's Sudden Rally: Analyzing the Price Data and What Comes Next

Zcash is back from the dead.

After years of languishing in relative obscurity, a period where it was dismissed by many as a relic of the 2018 crypto cycle, the privacy-focused coin has staged a violent comeback. The numbers are, frankly, startling. The Zcash (ZEC) price is up more than 250%, with some metrics showing a nearly 400% gain in just the last 30 days. It has sliced through resistance levels, hitting multi-year highs above $230—a move that saw Zcash reclaims $200 level after three years amid renewed interest in privacy coins—and liquidating millions in short positions along the way.

The social media chatter, a qualitative data set I always monitor for sentiment velocity, has shifted from nonexistent to euphoric. We’re seeing high-profile endorsements and grand proclamations about the dawn of a new privacy era.

But when an asset that has been dormant for so long moves this aggressively, my first instinct isn't to join the parade. It's to ask a simple question: what changed? Is this a fundamental re-rating of Zcash’s value proposition, or are we witnessing a classic, liquidity-fueled narrative rotation—a speculative echo bouncing off the walls of a bull market? The data suggests the latter.

Deconstructing the Narrative Engine

To understand the ZEC price explosion, you have to dissect the three primary catalysts driving it. None of them, on their own, are entirely new, but their convergence has created a feedback loop of immense potency.

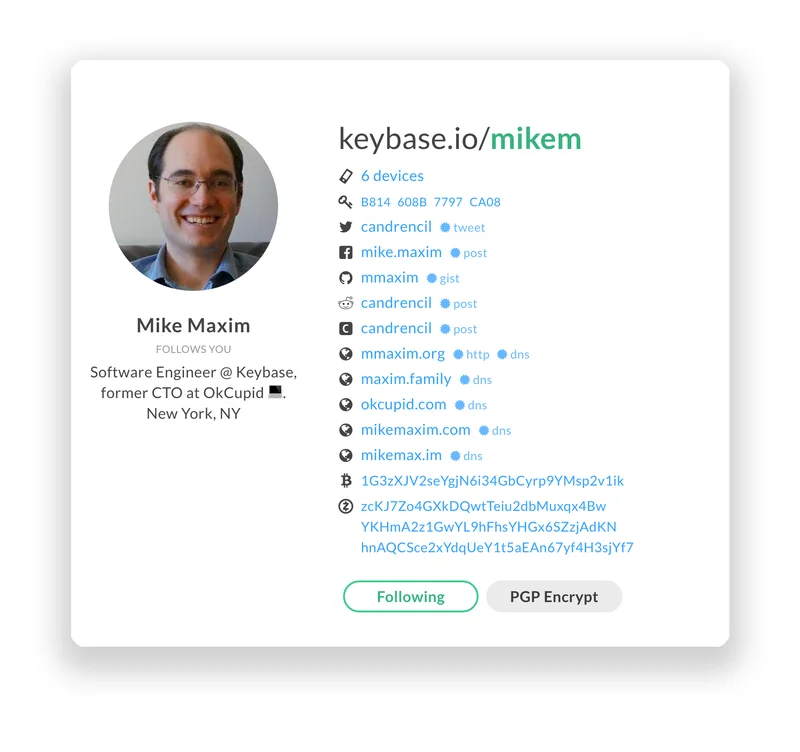

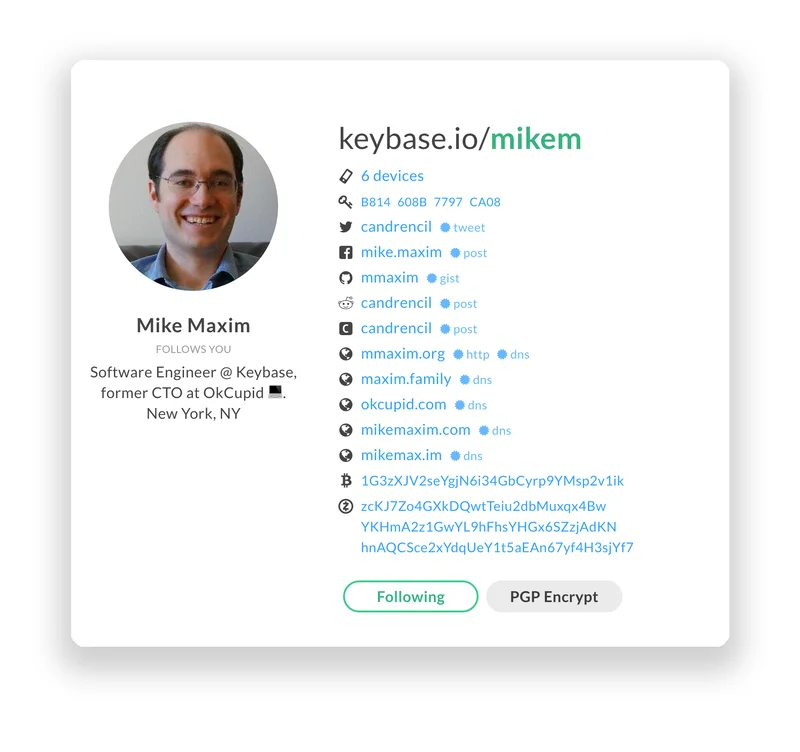

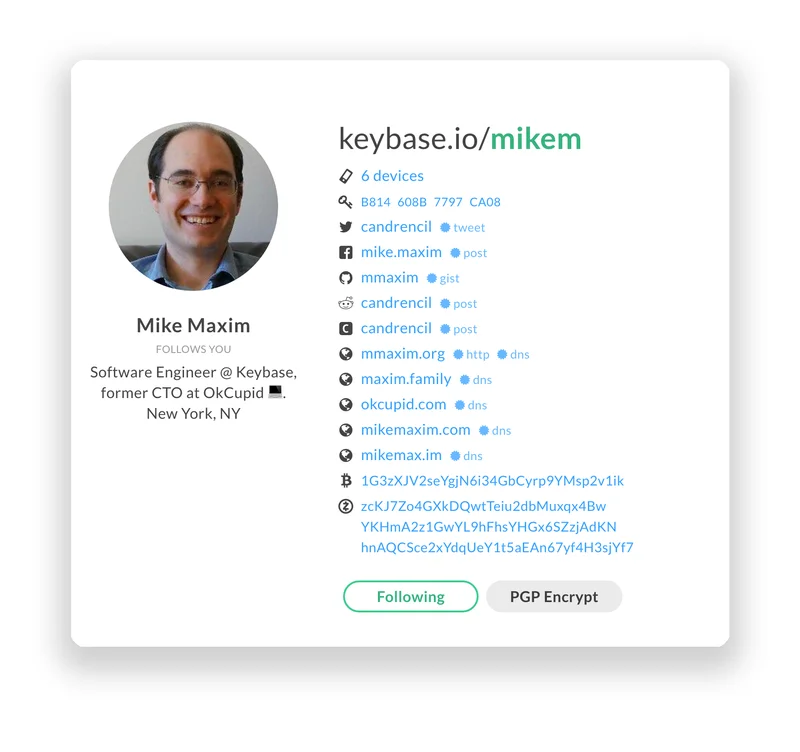

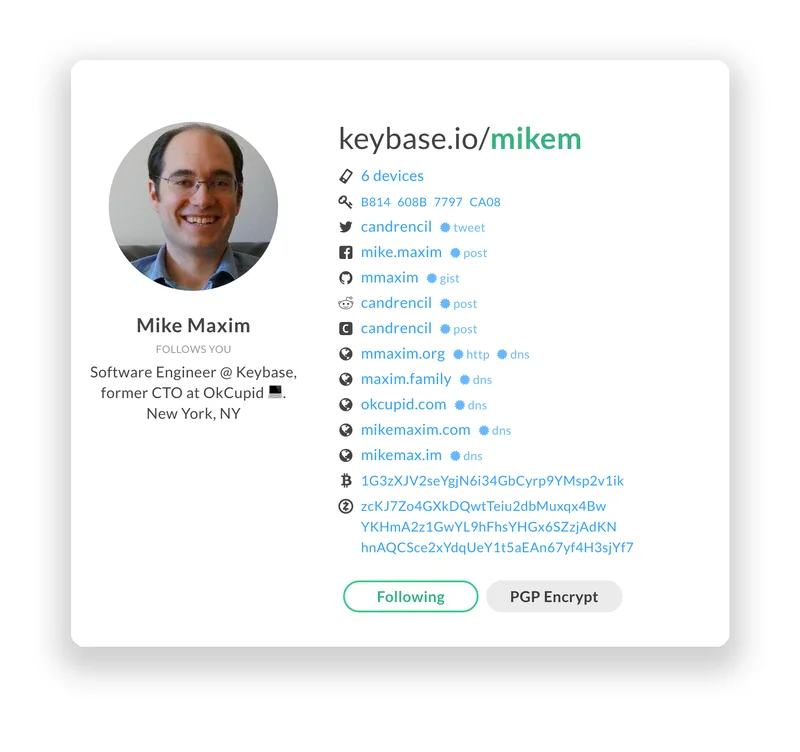

First, there’s the institutional angle. The mere existence of the Grayscale Zcash Trust (and the subsequent speculation about a potential ZEC ETF filing) has provided a powerful narrative anchor. It gives the rally a veneer of institutional legitimacy, suggesting that "smart money" is finally recognizing Zcash's value. This is amplified by endorsements from figures like venture capitalist Naval Ravikant, who framed ZEC as “insurance against Bitcoin.” This is a potent marketing line, perfectly timed for a market where Bitcoin is cooling after a historic run.

Second, we have the macro tailwind. As governments globally signal a push for greater financial surveillance and control, the demand for privacy-preserving technologies is no longer a niche, cypherpunk concern. It’s becoming a mainstream hedge. This renewed interest isn’t just boosting Zcash; we’ve seen similar, though less dramatic, moves in other privacy coins like Monero (XMR) and Dash. As some have noted, Privacy Tokens Zcash, Dash, Railgun Rip Higher as Market Rotates Back to 2018 Narratives, treating the entire sector as a single thematic basket.

And this is the part of the analysis that I find genuinely puzzling. While the macro narrative is sound, the capital flows seem disproportionately focused on ZEC. Is this because Zcash’s “opt-in” privacy model (offering both transparent and shielded transactions) is seen as more palatable to regulators? Or is it simply that ZEC had more room to run, making it a higher beta play on the privacy narrative? The data isn't clear, but the concentration of capital suggests a momentum trade more than a carefully considered allocation across the sector.

This entire sequence feels less like a slow, deliberate re-evaluation and more like capital rotation in its purest form. Think of it like a flock of starlings turning on a dime. For months, liquidity swarmed around AI tokens, then it darted to meme coins. Now, with the majors taking a breather, that same pool of fast-moving capital needed a new story to latch onto. The forgotten privacy sector, with its compelling macro backdrop and beaten-down valuations, was the perfect target.

A Quantitative Reality Check

While the narrative is compelling, the numbers tell a more sober story. Let’s inject some context into this rally. The coin is up nearly 400% in a month—to be more exact, some data points show a 385% gain in the last 30 days. That kind of vertical price action is rarely sustainable and is often a sign of speculative excess, not foundational strength.

We’re seeing daily spot trading volumes exceed $1.5 billion for ZEC alone. This indicates intense, short-term interest, but it also points to a market dominated by traders, not long-term investors. High volume on a parabolic move can be a sign of distribution, where early entrants are selling into the manufactured hype.

Then there’s the historical perspective. Even after this monumental surge, Zcash remains more than 90% below its all-time high of $3,191 set back in 2016. That single data point should temper any irrational exuberance. This isn’t a recovery to former glory; it’s a significant bounce from a very, very deep trough. Does this surge change the long-term trajectory? Perhaps. But it doesn't erase years of underperformance.

There's also a long-running heuristic among traders that warrants mentioning. Outsized spikes in ZEC have, at times, coincided with local tops in the Bitcoin price. (This isn't an ironclad rule, of course, but an observed correlation that serves as a sort of yellow flag for market exuberance.) It suggests that when speculative froth reaches its peak, capital flows into higher-risk, lower-cap altcoins like ZEC right before a market-wide correction. Is this time different? The current setup, with Bitcoin cooling just under $122,000, certainly fits the historical pattern. The question we should be asking isn't just "Why is Zcash going up?" but rather, "What does this Zcash rally tell us about the health of the broader market?"

The Math of a Momentum Trade

Let's be clear: Zcash’s technology, particularly its use of zk-SNARKs for shielded transactions, is legitimate and important. The renewed focus on financial privacy is a valid and enduring macro theme. But the current price action is not a direct reflection of that utility. It is the result of a momentum trade, pure and simple. It's a confluence of a dormant asset, a compelling narrative, and a flood of speculative capital looking for its next thrill. The catalysts are real, but the market's reaction is disproportionate. The risk now is that Zcash has become a proxy for the privacy narrative itself, and when that narrative inevitably cools, the exit will be just as swift and violent as the entry.