Zcash Comeback in 2025: What's Driving the Sudden Surge?

Zcash's Privacy Push: Is This Rally Built to Last?

Zcash (ZEC) has been the talk of the crypto town lately, surging a reported 700% since September. That’s not a typo. In a market often driven by hype and fleeting trends, such a massive move demands a closer look. The resurgence is attributed to a renewed focus on privacy, but as someone who’s spent years dissecting market narratives, I'm always wary of a single explanation. Let's dig into the numbers and see if this rally has legs, or if it's just another flash in the pan.

The core argument centers around privacy. Bitcoin, despite its revolutionary nature, isn’t exactly private. Every transaction is visible on the blockchain. Zcash, on the other hand, uses zero-knowledge proofs (zk-SNARKs) to shield transactions, hiding the sender, receiver, and amount. This isn’t new technology; Zcash launched in 2016. So, why the sudden interest now?

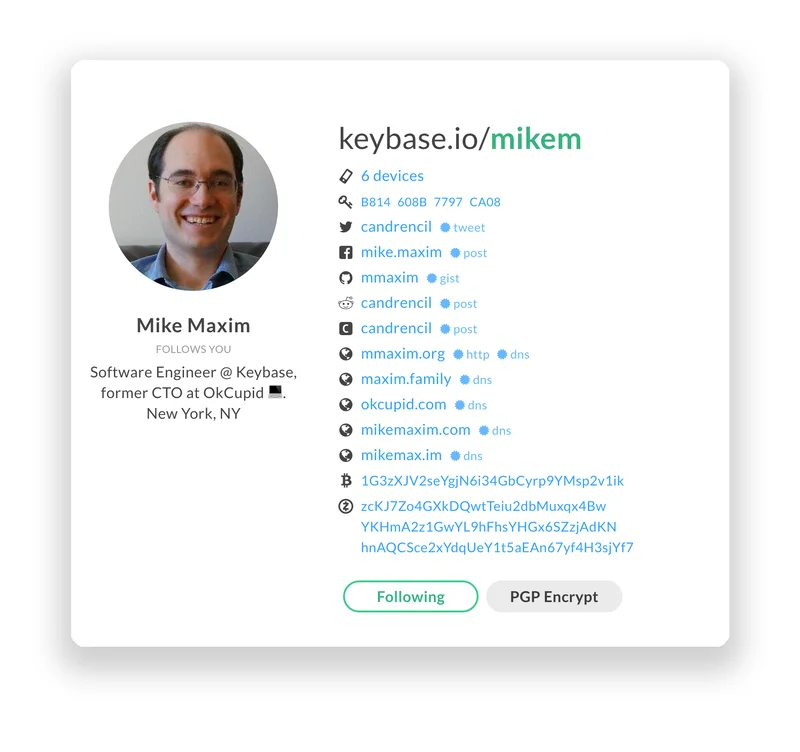

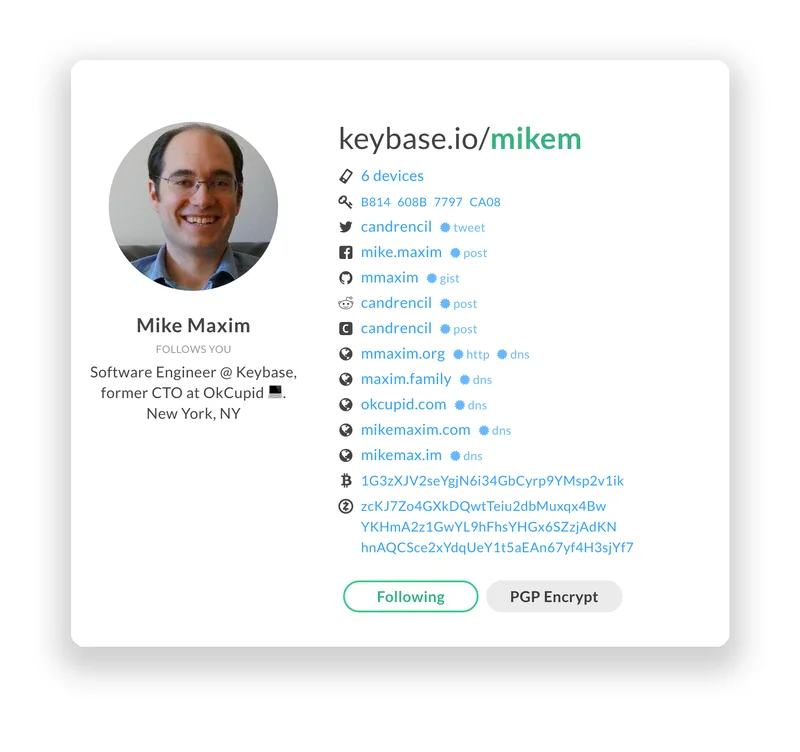

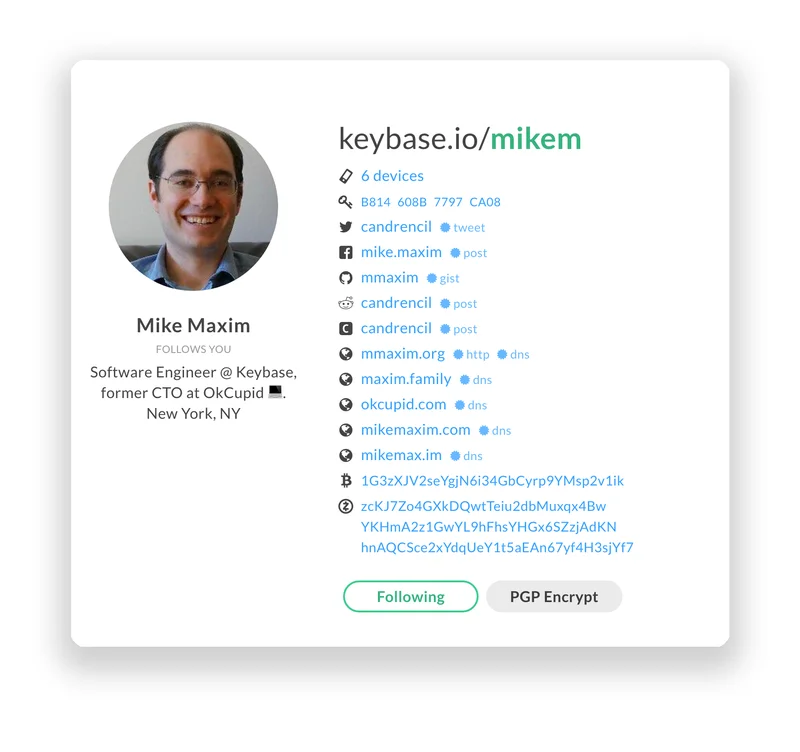

One factor is regulatory pressure. Bitcoin privacy tools like Samourai and Wasabi have faced increasing scrutiny, with Samourai's founders even being arrested. This crackdown likely pushes users towards alternatives like Zcash. But is it enough to justify a 700% surge? Perhaps not on its own. We’ve also seen improvements in Zcash's usability. The Zashi wallet, launched in March 2024, simplifies the process of shielding transactions. And NEAR Intents integration allows users to move assets in and out of Zcash's shielded pools without exposing every step on the blockchain. It's like a financial cloaking device.

Still, the numbers paint a mixed picture. While the percentage of ZEC supply in shielded pools has increased (now over 30%), the network's node count remains relatively small, hovering around 100-120. Compare that to Bitcoin's 24,000 nodes, and you see a significant discrepancy. A smaller node count raises concerns about network security and decentralization. It’s like having a high-security vault with only a handful of guards.

And here's where my analyst instincts kick in. The Electric Coin Company, the team behind Zcash, has been actively promoting these privacy features. Are these “organic” mentions, as the Zcash Foundation claims? Or is there a more coordinated effort at play? Economist Lyn Alden has cautioned investors not to fall for "coordinated token pumps," a warning that should give any potential ZEC buyer pause. I'm not alleging anything nefarious, but it’s always prudent to be skeptical when a narrative becomes too convenient.

The Myriad Markets prediction platform offers another interesting data point. While predictors are bearish on Bitcoin reaching a new all-time high by the end of 2025, they're bullish on Zcash maintaining its strength. This suggests a short-term speculative interest, but not necessarily long-term conviction. It’s like betting on a horse that's had a sudden burst of speed, rather than one with a proven track record.

So, Is Privacy Enough to Sustain This Rally?

Zcash's surge is undoubtedly impressive, but it’s crucial to separate the hype from the underlying fundamentals. While the renewed focus on privacy and improvements in usability are positive developments, the small node count and potential for coordinated promotion raise red flags. Ultimately, whether ZEC’s price strength persists depends on its ability to translate speculative momentum into sustained network growth. And that's a question the numbers alone can't answer.