ELF Stock Falling: Tariffs, Valuations, and What We Know

E.l.f. Beauty (ELF) took a beating recently, with the stock price plummeting. We're talking a 25% drop in a single day according to some data, and nearly 50% off its 52-week high. The immediate trigger? Mixed third-quarter results and a disappointing financial outlook. Revenue missed estimates, and the forecast for the full year came in below Wall Street's projections. Operating margin took a nosedive, from 9.3% to a paltry 2.2%.

But here's the question: is this a market overreaction, a buying opportunity, or a legitimate cause for concern? The knee-jerk reaction is to say "overreaction." After all, the company still beat earnings per share estimates (adjusted, of course). And analysts, for the most part, still seem bullish.

Digging into the data, however, reveals a more nuanced picture.

Tariffs, Margins, and Insider Selling

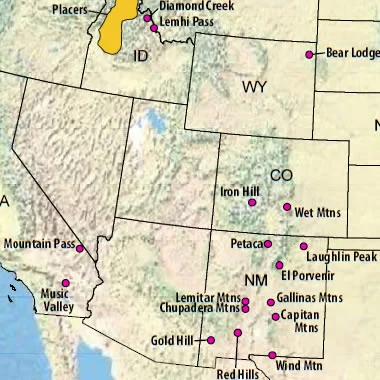

One key factor is tariffs. E.l.f. sources almost all its products from China. The company reported an 84% drop in net income after new tariffs drove up costs. Gross margin declined, leading to a price hike. The CEO says the tariff headwinds should "moderate" in the second half, but the initial impact was brutal. This isn't just an E.l.f. problem. Many "Made in America" brands rely on global supply chains. If tariffs persist or expand, other consumer goods and retail ETFs could see similar earnings revisions.

But there's another, perhaps more troubling, data point: insider selling. Over the past six months, E.l.f. insiders have engaged in 52 sales of stock on the open market, and zero purchases. CEO Tarang Amin alone sold over 143,000 shares for an estimated $18.5 million. Other executives, including . Scott Milsten and Mandy J Fields, also offloaded significant amounts of stock. Now, insider selling isn't always a red flag. Executives diversify their holdings for various reasons. But the sheer volume of sales, with zero buys to offset them, raises eyebrows.

I've looked at hundreds of these filings, and the uniformity here is striking. It suggests a coordinated effort to reduce exposure, not isolated incidents.

The analysts, meanwhile, remain largely optimistic. We've seen 10 firms issue buy ratings on the stock, and zero firms issue sell ratings. Median price target? $152.5. But these targets were set before the latest earnings miss and stock plunge. Piper Sandler, for example, slashed its target price to $100 on November 6th. (A parenthetical clarification: this is still above the current trading price, but represents a significant downward revision.)

The discrepancy between analyst optimism and insider behavior is…interesting.

Is it possible that the analysts are simply behind the curve, slow to react to changing market conditions? Or are they privy to information that isn't yet reflected in the data? It’s tough to say.

The Valuation Question

Then there's the valuation. Even after the selloff, E.l.f. trades at around 70 times forward 12 months earnings. That's a valuation that might make sense for a high-growth tech company, not a cosmetics maker battling margin compression. Analysts at TD Cowen, UBS, and Piper Sandler have cut price targets and ratings, warning that core business growth is slowing even as Rhode, its Hailey Bieber-backed brand, shines. The market is telling us E.l.f. is worth less, but its valuation is still priced for perfection.

This is the part of the report that I find genuinely puzzling. The market seems to be pricing in continued high growth, even as the data suggests growth is slowing. It's like betting on a horse that's already past its prime.

The Market is Finally Seeing the Obvious

The market isn't always right, but it's rarely this wrong for this long. The data paints a clear picture: tariffs are hurting margins, growth is slowing, insiders are selling, and the valuation is still sky-high. The recent stock plunge isn't an overreaction; it's a correction. The market is simply catching up to reality.