Zcash's 2025 'Roadmap': What's in it, why it's pumping, and if we should even care

So, Zcash is going to the moon.

The price has jumped from a measly $50 to over $400 in what feels like five minutes. Its market cap just blew past Monero. The "experts" on Twitter, the ones who were calling it a dead project two months ago, are now pasting rocket emojis all over their timelines, sharing links to articles like Zcash creator ECC unveils Q4 2025 roadmap as privacy token's price and shielded supply surge. Everyone who held on is a genius, apparently.

And why? What's the catalyst for this biblical surge? What revolutionary, paradigm-shifting breakthrough did the Electric Coin Co. (ECC) just unleash upon the world?

They released a roadmap. For the fourth quarter of 2025.

Let that sink in. The market is pricing in a future that's still years away, based on a PDF that amounts to little more than corporate housekeeping. This isn't a breakthrough. It's a to-do list. It’s like a car company announcing they’re finally adding floor mats to their 2025 model, and the stock suddenly multiplies by eight. Give me a break.

The So-Called "Revolution"

Let’s actually look at this earth-shattering document, shall we? The big priorities for late 2025 are... "reducing technical debt." My god, hold the presses. In plain English, that means "cleaning up the mess we made earlier." It’s the digital equivalent of finally doing the dishes that have been sitting in the sink for a week. You don't get a medal for it.

What else? They’re adding "ephemeral addresses" for swaps and generating a new transparent address after a transaction to "minimize address reuse." This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of expectations. These are basic privacy-preserving features that should have been standard practice years ago. This isn't innovation; it's playing catch-up. Praising Zcash for adding this now is like praising a restaurant for finally deciding to wash its hands after handling raw chicken. It’s the bare minimum, and the fact that it's a headline item on a 2025 roadmap is, frankly, embarrassing.

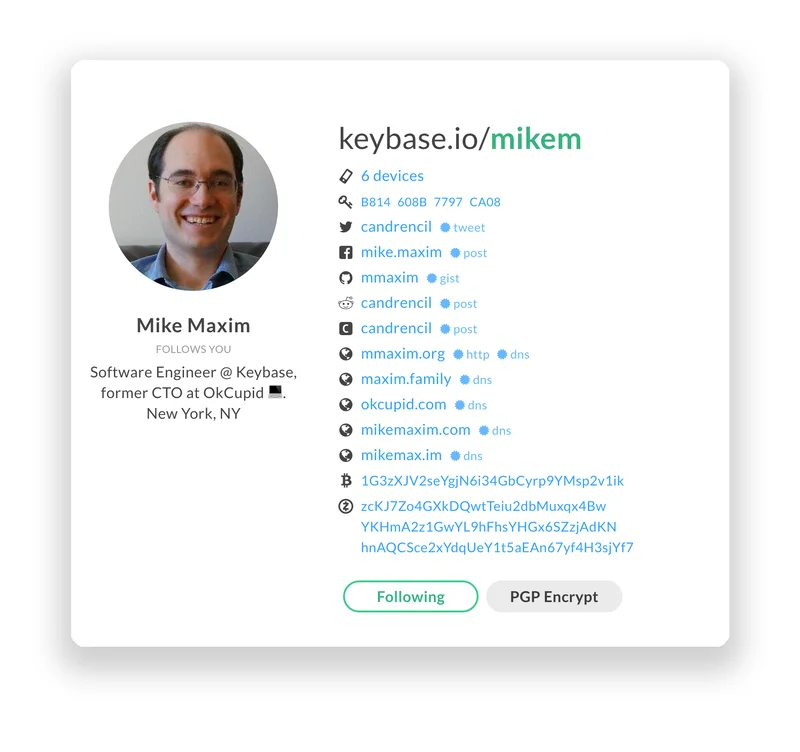

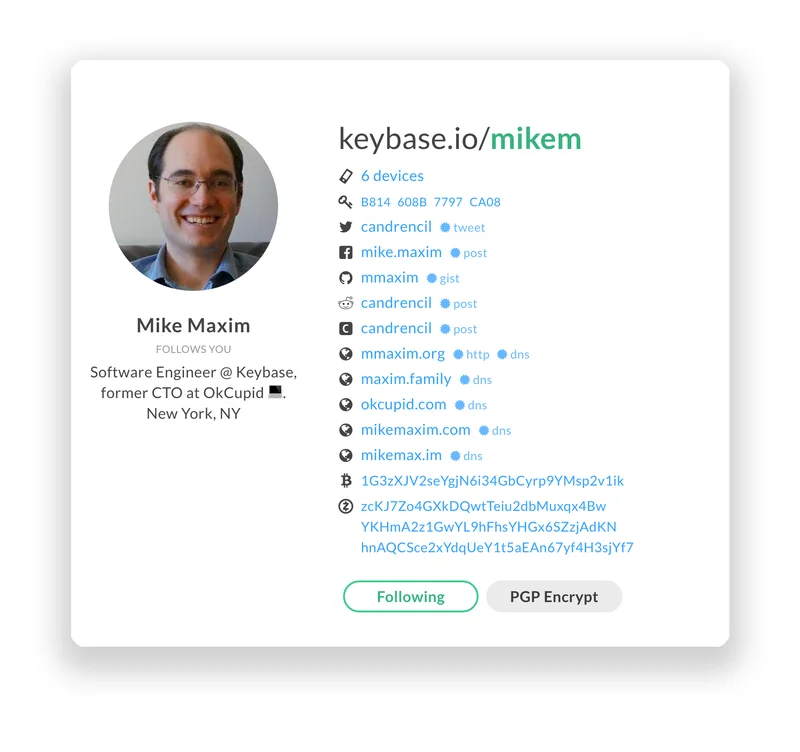

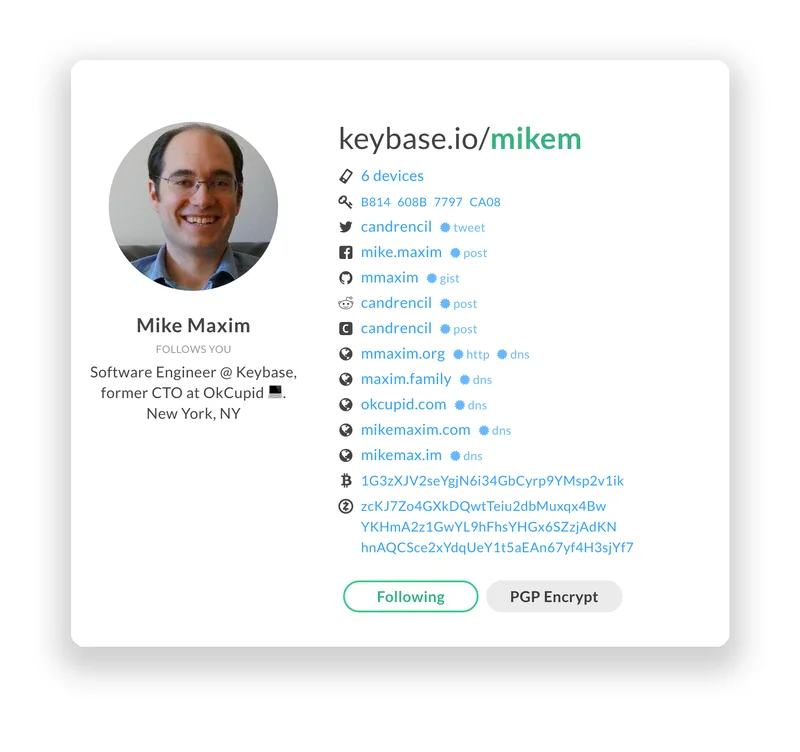

Then there’s some stuff about the Keystone hardware wallet and securing their own developer funds with multisig. I’m glad the team is securing their own bags, I really am. But how exactly does that justify a price surge that's added billions in market cap? Are we really supposed to believe that thousands of investors saw "P2SH multisig wallet support" and collectively decided, "This is it! This is the future of finance!"? Offcourse not.

The whole thing stinks. It feels like the market was a bone-dry forest, and this roadmap was a single, damp match that somehow caused an inferno. The fuel for this fire isn't fundamentals; it’s pure, uncut speculation. It’s people chasing a pump, desperate not to miss out, and they’re using this roadmap as the thinnest possible excuse to justify it. They want you to believe this is all because 4.1 million ZEC are now shielded in the Orchard protocol, as if every single one of those coins represents a true believer fleeing surveillance, and not just a whale looking to game the market...

A Convenient Crisis of Conscience

What really gets me is the performative piety of it all. The ECC team recently disabled the Coinbase on-ramp for their Zashi wallet, citing privacy concerns over a new session-token requirement. Noble, right? A brave stand against the centralized data-hoovering machine.

Except... what did they think was going to happen? You build bridges to these centralized exchanges, you play in their sandbox, and then you act shocked when they want to track what's happening on their platform? It’s like building a water park next to a volcano and then being surprised when you get ash in the lazy river. The entire crypto space, especially so-called "privacy" projects, has been trying to have its cake and eat it too for years—courting institutional money and exchange listings while pretending to be a revolutionary force for the common man. It ain't working.

This whole episode feels less like a principled stand and more like a convenient marketing opportunity. Notice how the price started pumping after all this? They get to look like privacy heroes while the token they effectively control goes on a speculative frenzy. It’s a perfect narrative.

Then again, maybe I'm just the crazy one. Maybe I’m the bitter old man yelling at the clouds while everyone else is getting rich off a JPEG of a monkey. The numbers are real, after all. The price is $420. But I can't shake the feeling that we're watching a grand illusion. The magic trick is convincing everyone that a glorified software update schedule is the secret to eternal wealth. And right now, the audience is eating it up. The question is, what happens when the applause stops?

This Is Just a Casino, Sir

Let's be brutally honest for a second. The price of ZEC has absolutely nothing to do with its technology, its roadmap, or its commitment to privacy. This is a speculative bubble, full stop. It's driven by the same degenerate gambling impulse that drives every other altcoin pump. People see a line go up, and they pile in, hoping to dump their bags on some greater fool before the music stops. The roadmap is just background noise—a flimsy piece of narrative scaffolding to make the gamble feel like a sophisticated "investment." The tech could be revolutionary or it could be a complete fraud; for 99% of the people buying right now, it simply doesn't matter.