The Crypto Market Correction: What's Driving It and Why It's a Glimpse of the Future

Here is the feature article, written in the persona of Dr. Aris Thorne.

---

The numbers were brutal. Bitcoin, down 8%. Ethereum, a gut-wrenching 15%. XRP, in what felt like a freefall, shedding over 20% of its value. Across the board, screens glowed red with the kind of carnage that sends investors scrambling for the exits. The trigger? A late-night post from Donald Trump on Truth Social, declaring a 100% tariff on Chinese software imports—a digital cannonball fired in the escalating trade war.

Panic was the predictable response. Headlines screamed 'Crypto market bloodbath! Bitcoin, Ethereum tank after Trump imposes 100% tariff on Chinese imports.' Social media feeds filled with dread. But when I saw the news flash across my screen, I didn't feel panic. Honestly, after the initial shock, I felt a strange sense of validation. This is the kind of breakthrough that reminds me why I got into this field in the first place. Because what we all witnessed wasn't the failure of a volatile asset class. It was its graduation ceremony, complete with fireworks and a violent, chaotic, and absolutely necessary rite of passage.

The Tremors Before the Quake

Let's be clear: the crypto market wasn't exactly a picture of serene stability before the geopolitical hammer fell. For days, the ecosystem had been showing signs of stress. Bitcoin was struggling to break past a stubborn resistance level around $124,000, and investors, sensing a ceiling, were beginning to take profits.

Under the hood, the engine was sputtering. Inflation fears in the U.S. were pushing the dream of Federal Reserve rate cuts further into the horizon. In simple terms, when the dollar gets stronger, riskier assets like crypto tend to look less appealing. We were also seeing significant outflows from the big institutional ETFs, a signal that the "smart money" was moving to the sidelines. It was a classic consolidation phase—a healthy, if nerve-wracking, pause. Analysts called it a "correction," a market catching its breath.

But this wasn't just a breather. It was the quiet intake of air before a hurricane. The market was already fragile, stretched thin by profit-taking and macroeconomic headwinds. It was a system primed for a shock. And then, a shock is exactly what it got.

The Shot Heard 'Round the Digital World

When Trump announced his tariff, he didn't just target microchips or manufacturing equipment. He targeted "critical software." In doing so, he inadvertently dragged the world of decentralized finance, an ecosystem built on code, directly into the crosshairs of a superpower showdown. The reaction was instantaneous and electric. The sheer velocity of the market's response was breathtaking—a multi-trillion dollar asset class convulsing in real-time based on a social media post, proving once and for all that crypto isn't in its own little sandbox anymore but is playing in the same geopolitical arena as oil and gold.

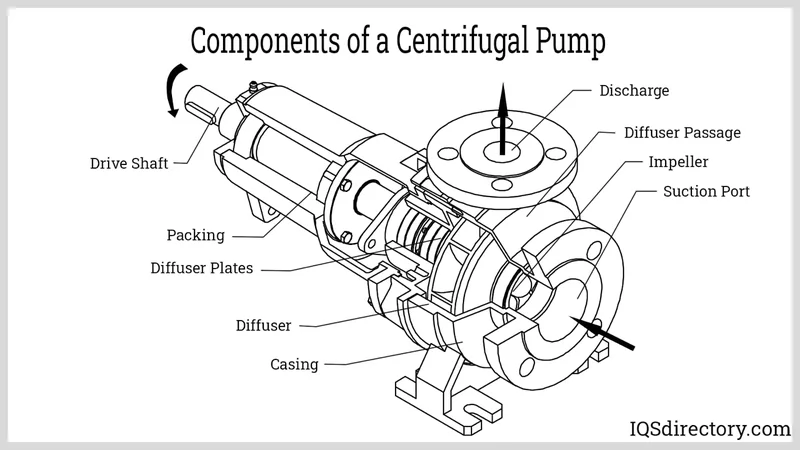

We saw over $9.5 billion in Bitcoin liquidations alone. These are essentially automated sell-offs triggered when traders who borrowed money to bet on rising prices suddenly can't cover their positions. Think of it like a series of dominoes, each one knocking over the next in a cascade of forced selling. It’s a brutal, unforgiving mechanism.

But look past the red ink. What does this event truly signify? For years, we’ve talked about crypto "going mainstream." We imagined it would be a smooth, upward ramp of adoption, with institutional buy-in and friendly regulation. We were wrong. This is what mainstream adoption actually looks like. It’s messy. It’s political. It’s being so important, so integrated into the global financial system, that you can be held hostage by a trade dispute between two world powers.

This is not unlike the moment the internet evolved from a geek's paradise into a tool of statecraft and a battleground for information warfare. It lost some of its innocent, utopian sheen, but it gained undeniable relevance. Crypto just had its own graduation day. It’s no longer a fascinating technological experiment. It is now a geopolitical fact. The question is no longer if crypto will matter on the world stage, but how its power will be wielded, controlled, and contested. Are we, the builders and believers, prepared for the responsibilities that come with that?

This Isn't a Crash; It's a Coming of Age

So, what happens now? We’ve just witnessed the violent collision of two worlds: the decentralized, borderless vision of crypto and the very centralized, border-obsessed reality of nation-state power. This crash wasn't a sign of crypto's inherent weakness. It was a demonstration of its newfound significance. The price of a seat at the big table is that you get shaken when someone slams their fist on it. For the first time, crypto is at that table. It’s a terrifying, exhilarating, and profoundly important place to be. Welcome to the main event.