Boeing Stock: What This Dip Really Means for Its Future

It’s easy to look at a stock ticker and feel a jolt. Seeing a giant like Boeing (BA) dip nearly 3% in a day, on the back of a wider-than-expected loss, sends a ripple of anxiety through the market. The headlines write themselves: "Boeing Stumbles," "Losses Mount," "Investor Confidence Shaken," all asking the same question: Why Is Boeing Stock Falling Wednesday? - Boeing (NYSE:BA). And yes, on paper, the numbers from their third-quarter report look bruising. An adjusted loss of $7.47 per share is a tough pill to swallow, especially when the market was bracing for something closer to $5.15.

But I want you to take a breath with me. Step back from the ticker. Let's look past the quarterly panic and see the machine for what it is. Because what I see isn't just a story about a loss; it's a story about the brutal, beautiful, and breathtakingly complex physics of progress. When you're building machines that ferry hundreds of souls through the stratosphere at 600 miles per hour, the path from blueprint to reality is never a straight line. It’s a winding, expensive, and often delayed journey. And that, right there, is where the real story begins.

The Anatomy of an Ambitious Setback

Let’s get the big, scary number out of the way first: the $4.9 billion pre-tax charge tied to the 777X program. That single item is the primary culprit for the ugly bottom line, slicing a staggering $6.45 off the earnings per share. Now, a "charge" like this is financial jargon—in simpler terms, it's the company acknowledging that a project is going to cost more and take longer than they originally planned. It's an accounting of reality.

And what is that reality? It’s the herculean effort of certifying the largest and most efficient twin-engine jet the world has ever seen. The 777X, with its revolutionary composite wings and folding wingtips, is a marvel of engineering. When I first saw the designs for those wings, I honestly just sat back in my chair, speechless. We are talking about a wingspan wider than a football field that can fold up to fit at existing airport gates. The sheer audacity of it is inspiring. But audacity comes with a price tag, and that price is paid in time, money, and unforeseen challenges.

This isn’t a failure of the airplane. CEO Kelly Ortberg himself noted that the 777X "continues to perform well in flight testing." This is a failure of the schedule. This is the friction that occurs when groundbreaking ambition meets the unyielding demands of regulatory safety and supply chain logistics. It’s like the early days of the Apollo program; no one knew exactly how long it would take to solve the thousands of individual problems standing between them and the moon, but they knew the goal was worth the struggle. Is it disappointing? Of course. But is it a sign the company is fundamentally broken? I don’t think so. I think it's a sign they're still daring to build incredible things.

The Engine Under the Hood

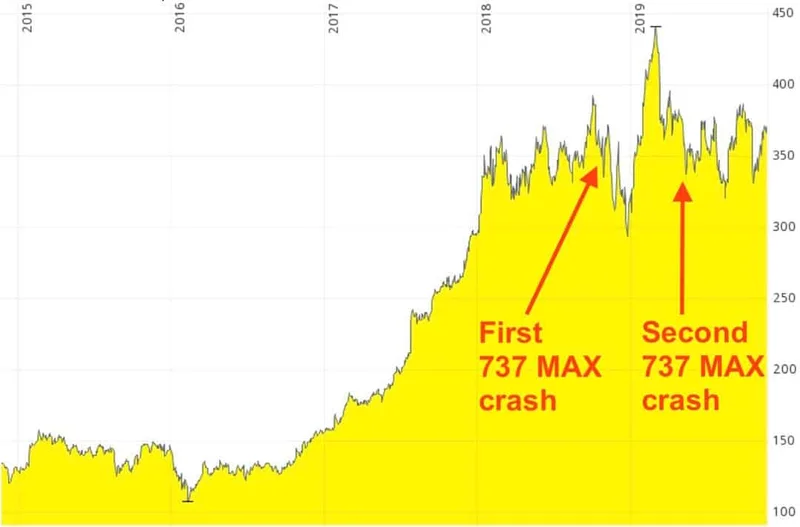

If you only focus on that 777X charge, you miss the powerful hum of the engine running underneath. Let’s look at the actual operations. Commercial airplane deliveries hit 160 for the quarter. That’s the highest number since 2018. The 737 program, the workhorse of the fleet, has stabilized production at 38 jets per month and is getting the green light from the FAA to ramp up to 42. That’s not just a number—that’s a signal of restored trust, of supply chains healing, of a factory floor finding its rhythm again. The speed of this recovery is just staggering—it means the gap between the turbulence of the past and a more stable future is closing faster than many of us thought possible.

And what about the order book? The company’s backlog grew to an astronomical $635.7 billion. Let that number sink in. That represents more than 5,900 commercial airplanes waiting to be built. This isn't a company scrambling for work. This is a company with a decade of demand lined up at its door. It’s like a massive supertanker caught in a storm. On the deck, the waves are crashing, the wind is howling, and the crew is getting soaked. But deep in the hull, the colossal engines are still turning, the momentum is immense, and the destination is locked in.

We can’t ignore the human element, either. The ongoing machinist strike in the defense wing is a stark reminder that these technological marvels are built by people. The dispute over wages and benefits isn't just a line item; it's a conversation about the value of the hands that shape the titanium and wire the flight controls. For a company focused on "restoring trust," that trust must extend not just to airlines and passengers, but to its own workforce. How can we expect to build the future of flight if the people doing the building feel left in the past? It’s a critical question Boeing has to answer, not just for its balance sheet, but for its soul.

The Physics of Progress

So, what's the real story here? It’s not about one bad quarter. It’s about the messy, expensive, and unavoidable reality of pushing the boundaries of what’s possible. The headlines will always focus on the turbulence, but the fundamental physics of Boeing’s business—a massive backlog, recovering production, and a portfolio of essential defense and service contracts—suggest a powerful upward trajectory. Progress in aerospace isn't a smooth, clean line on a chart; it's a series of controlled explosions, course corrections, and moments of sheer, terrifying, brilliant invention. This quarter was one of the painful corrections, but the invention, the ambition, and the demand are all still there, waiting to take flight.