Silver's Insane Price Spike: What's Really Going On and Who's Getting Played

So, silver is popping. Big time. We’re staring down the barrel of $50 an ounce, a price that would have been laughed out of the room not that long ago. Gold is flirting with $4,000. Everyone, from Wall Street suits to your conspiracy-minded uncle, is suddenly an expert on precious metals. The headlines are screaming about "safe havens" and "record highs."

And I’m supposed to be impressed?

Let's be real. This isn't an investment boom. This is a fear index. Every tick upwards in the price of silver is just a digital readout of our collective anxiety. The world’s on fire—geopolitically, economically, you name it—and people are running to cram shiny metal under their floorboards. It’s the 21st-century equivalent of burying gold in the backyard, except now you can do it with an ETF while doomscrolling through news of another government shutdown or some fresh hell brewing overseas.

This isn’t a strategy. It's a panic attack priced in dollars per ounce.

The Great Panic Buy

You don't need a PhD in economics to see what's happening. The fact sheets lay it out plain as day. Two years since the Hamas attack. A U.S. government that can’t keep the lights on. Political chaos erupting in France. Trump’s tariff policies sending shockwaves. It’s the perfect storm, a beautifully concieved cocktail of instability designed to make people terrified of the paper money in their wallets.

And when people get scared, they do irrational things. Remember the great toilet paper shortage? This is the same herd mentality, just with a much higher price tag. The rush to gold and silver is like a global run on Charmin. A hedge fund founder, Ken Griffin, calls the rush "concerning." Of course he does. The guys at the top get nervous when the little people start trying to play their game, abandoning the rigged stock market for something they can actually hold.

The financial media, ever helpful, frames it with headlines like Gold price powers to record high, silver 14-year high, platinum 13-year peak and quotes like this one from an analyst at StoneX: "New cohorts of investors [are] looking for hedges against uncertainty and political difficulties." Let me translate that from PR-speak into English: "A whole new generation of people are terrified their leaders are incompetent clowns, and they're desperate to find something—anything—that won't evaporate when the whole system shudders."

It's just incredible. I can't get a stable internet connection half the time, but some guy in his suburban basement is watching the price of palladium and thinking he's cracked the code. Give me a break. Are we really supposed to believe that owning a few American Silver Eagles is the key to weathering the collapse of civil discourse? What’s the plan, throw them at the zombies?

Your Grandpa's Investment is Suddenly Cool Again

The industry has this all packaged up for you, of course. You can buy silver ETFs if you don't want to actually touch the stuff. Or you can get physical bullion, bars and coins you can stack up in a safe. I can just picture it now: some guy, sitting in a dimly lit room, the blue light of a market tracker flickering on his face as he lovingly polishes a 10-ounce silver bar. The sound of the metal is a dull, satisfying thunk. He feels secure. He feels smart.

He’s missing the point entirely.

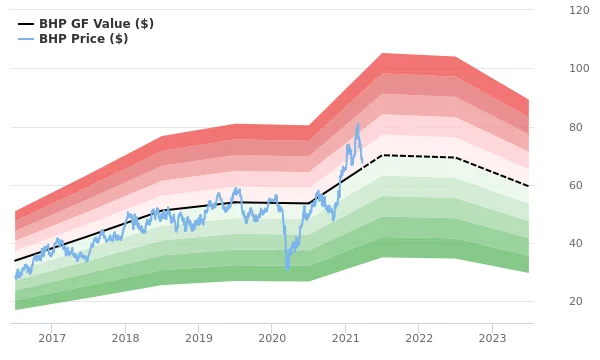

For a hundred years, silver has been a dog of an investment compared to stocks. A 96% underperformance against the S&P 500 isn't just lagging; it's a complete and total ass-kicking. But now, because fear is the hottest commodity on the market, it's having its moment in the sun. This is just another bubble. No, a bubble implies something light and airy—this is a lead balloon painted silver, waiting to drop on the heads of anyone who bought in at the top.

And the financial gurus on TV are just egging them on, because... well, because that's their job. They sell picks and shovels during a gold rush, and right now, the rush is on. They talk about "price spread" and "spot silver" to make it all sound scientific and sophisticated. It ain't. It's just supply and demand, and right now the demand is being fueled by pure, uncut political terror.

Maybe I'm the crazy one. Maybe this time is different and having a portfolio weighted 15% in precious metals will save everyone. Then again, maybe it's all just a high-stakes LARP for people who've given up on fixing the actual problems.

A Shiny, Useless Security Blanket

Look, I get it. The world feels like it's coming apart at the seams. Turning your rapidly devaluing cash into a tangible asset feels proactive. It feels like you're doing something. But you're not solving the problem. You're just buying a very expensive security blanket. The real issues—political polarization, global instability, economic inequality—don't give a damn about the spot price of silver. Stacking bars of metal is a symptom of the disease, not the cure. It's the ultimate vote of no confidence in our entire system, and while it might make you feel safer, it does absolutely nothing to stop the building from burning down.