BHP Stock: The Price vs. Rio Tinto

So, you’re looking at BHP Group and trying to figure out if it’s a golden ticket or a grenade with a loose pin. Good luck. I’ve been staring at the data, the reports, and the so-called “expert analysis,” and I’m more convinced than ever that the entire financial world runs on tarot cards and wishful thinking.

Let’s get one thing straight. When you see a news alert that some firm called "Abel Hall LLC" bought $349,000 worth of stock, you’re supposed to be impressed. See? The smart money is moving in! Except, it’s not. For a company with a market cap of $140 billion, $349k is the equivalent of finding a nickel in the couch cushions. It’s meaningless. The reports are full of this stuff—Costello Asset Management buying a whopping $26,000 position. Give me a break. That’s not a strategic investment; that’s a rounding error. It’s noise designed to make you feel like something is happening, when in reality, nothing is.

The real comedy starts when you look at the Wall Street analysts. One analyst has a "Strong Buy" on the stock. One has a "Sell." Seven—count 'em, seven—are planted firmly on the fence with a "Hold." A "Hold" rating is the most useless piece of advice in human history. It’s the financial equivalent of a shrug. It means, "I have absolutely no idea what’s going to happen, but I don’t want to be wrong, so I'll just say 'don't do anything' and collect my paycheck." This is a bad sign. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of indecision. What are we, the people actually putting our own money on the line, supposed to do with that kind of gutless consensus?

The China Syndrome and a Potash Pipe Dream

Forget the piddly institutional buys and the spineless analyst ratings. There's only one story that actually matters here, and it’s being criminally downplayed: China.

Bloomberg reported that China’s state-run mineral buyer told its steelmakers to just... stop buying iron ore from BHP. This is BHP’s biggest product and China is its largest customer. This should have sent the bhp stock price into a nosedive. Instead, the stock wobbled a bit and then recovered. Are investors really that sedated? Or is everyone just assuming this is a temporary negotiating tactic? Maybe it is. But what if it’s not?

This whole situation is like a high-wire act. For years, BHP has been walking across a wire stretched over the Grand Canyon, with China holding one end. It’s been a profitable walk. But now, China is shaking the wire. Just a little jiggle, to remind BHP who’s in charge. And everyone on the ground is looking up and saying, “Yeah, looks stable to me. Hold.” It’s insane.

Of course, CEO Mike Henry isn’t an idiot. He sees the writing on the wall. That’s why you hear all this talk about diversification. Potash! Copper! Carbon capture! It all sounds very forward-thinking and responsible. They bought Oz Minerals to boost their copper production, which is great because copper is essential for the "energy transition" everyone loves to talk about. But iron ore still accounts for 55% of the company's core earnings. Fifty-five percent. Their plan to pivot away from that is a long, slow, expensive turn of a massive battleship, and they’re trying to do it while their main customer is threatening to torpedo them.

So, when they talk about M&A and finding new deals, what they’re really saying is, “We need to frantically buy other companies so we’re not completely at the mercy of Beijing.” It’s a strategy born of desperation, not strength. As one report puts it, the China-BHP spat reinforces M&A appeal. And don't even get me started on the whole Brazil dam settlement thing, another legacy headache that just won't go away. Analysts are busy Assessing BHP After Share Slide and $1.4B Brazil Dam Settlement Offer, but it’s just one more distraction from the core problem.

A Dividend Bribe and a Phony Valuation

Amidst all this uncertainty, what does BHP do? It raises its dividend. Of course it does. It’s the oldest trick in the book. When the story gets shaky, you throw cash at your shareholders to keep them quiet and happy. "Don't worry about our massive geopolitical risk! Look at this shiny 441.0% yield!" It’s a bribe, plain and simple. It’s a payment to distract you from the fact that the company’s fate rests on a political standoff with a global superpower.

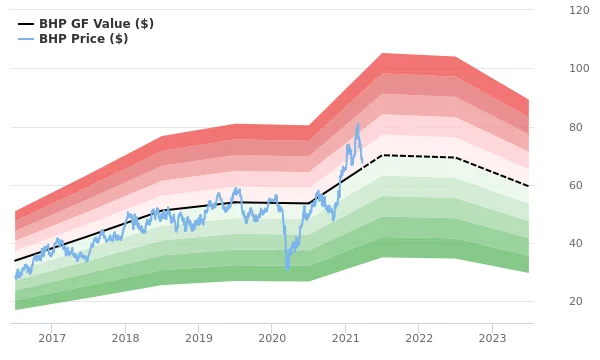

And then there’s the valuation. Some number-crunchers ran a Discounted Cash Flow (DCF) model and concluded the stock is undervalued by about 13.7%. This is where my eyes glaze over. A DCF model is just a fancy spreadsheet where you plug in a bunch of guesses about the future. Guesses. They project free cash flow out to 2035. Can you even confidently predict what you’re having for lunch next Tuesday? These models are completely dependent on the assumption that the future will look something like the past, which is offcourse a ridiculous assumption when China could change the entire game with a single memo.

Honestly, the whole thing feels like a setup. The company is facing an existential threat to its primary business model, but the stock is holding steady, analysts are telling you to do nothing, and the dividend check is in the mail. It all seems a little too calm, a little too neat. Maybe I'm the crazy one here. Maybe the market has priced all this in and this is just the new normal for global commodity giants like BHP and its rival rio stock. Or maybe…

One Dragon, One Basket

Let’s be real. All the talk about diversification, dividends, and analyst ratings is just static. The entire investment thesis for BHP boils down to one question: What is China going to do next? Everything else is a footnote. You aren't investing in a mining company; you're placing a bet on geopolitical negotiations you have zero insight into. If you're comfortable with that, then by all means, buy the stock. But don't pretend it's a "value" play based on some spreadsheet. It's a gamble, and the house is in Beijing.