SMCI Stock Tanks: Disappointing Earnings and What's Next?

Super Micro's Earnings Miss: Is This the End of the AI Hype Train?

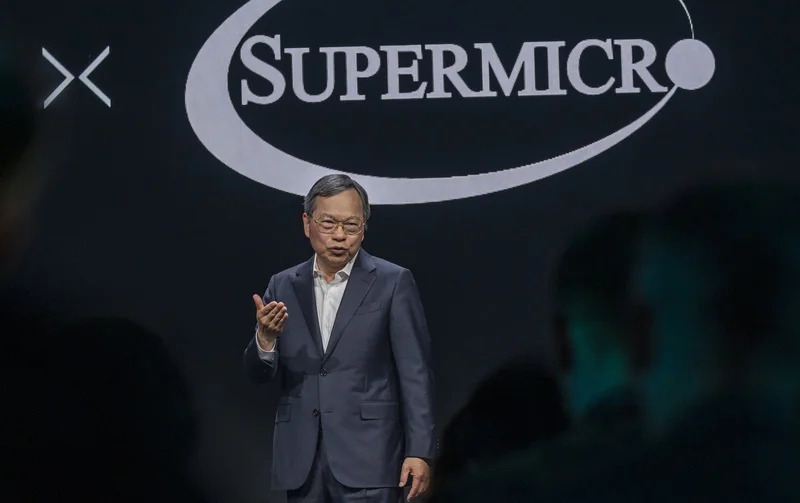

So, Super Micro (SMCI) shits the bed with its earnings report. Big deal, right? Another overhyped stock getting a reality check. But let's be real, this ain't just another stock. This is SMCI—the darling of the AI boom, the poster child for "innovation" and all that jazz.

The company reported earnings of $0.35 per share, missing the analyst consensus of $0.40. And revenue? $5.01 billion, way short of the expected $5.99 billion. Ouch. The stock price promptly took a nosedive of 6.2%. I mean, are we really surprised? Anyone who thought this gravy train could run forever was clearly drinking the Kool-Aid. According to Super Micro Computer (NASDAQ:SMCI) Stock Price Down 6.2% on Disappointing Earnings, the stock price took this hit due to disappointing earnings.

The Numbers Don't Lie (Or Do They?)

Okay, let's dig into the numbers a little deeper. First-quarter net sales were down from both the previous quarter and the same quarter last year. Gross margin? Also down. Cash flow? Used up by operations. This isn't just a "minor setback"; this looks like a fundamental problem.

And then there's the Q2 outlook: adjusted EPS of 46 cents to 54 cents, versus the 61 cent analyst estimate, and revenue of $10 billion to $11 billion, versus the $7.82 billion estimate. Wait, what? Are they lowballing or overpromising?

Here's where it gets interesting. The Zacks Consensus Estimate beat the EPS by 25% last quarter. So, are analysts just terrible at their jobs, or is Super Micro playing games with expectations? Maybe it's both. It's also worth noting that CFO David E. Weigand dumped 25,000 shares of SMCI in September. I'm not saying insider selling is always a red flag, but, you know, it's usually a red flag. Like rats fleeing a sinking ship.

The Analyst Circus: A Bunch of Clowns?

Speaking of analysts, what a joke. One minute they're upgrading SMCI to "hold," the next they're slapping a "neutral" rating on it. Then there's Bank of America, initiating coverage with an "underperform" rating and a $35 price objective. These guys are about as useful as a screen door on a submarine.

According to MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $47.57. So basically, nobody has a freakin' clue what's going on.

And get this: Despite the recent dip, SMCI stock is still up 66.5% since the beginning of the year, compared to the S&P 500's gain of 16.5%. This just proves that hype can carry a stock a long way, even when the underlying fundamentals are questionable.

The Cookie Crumbles

Oh, and while we're at it, let's talk about cookies. Not the delicious kind, but the tracking kind. Turns out NBCUniversal uses cookies and similar technologies to track users across its websites and services. I mean, give me a break. Everyone's doing it, but it's still creepy as hell.

They claim it's for "personalization" and "advertising," but let's be real: it's about collecting as much data as possible to squeeze every last drop of profit out of us. And they're not even subtle about it. They have a whole "Cookie Notice" explaining how they do it and how you can "manage" your preferences. As if we have any real control.

So, What's the Real Story?

Super Micro's earnings miss isn't just a blip; it's a sign that the AI hype train might be running out of steam. The company's fundamentals are shaky, the analysts are clueless, and the insiders are selling. Maybe, just maybe, it's time to take some profits and move on. Or, you know, maybe I'm just being a cynical jerk. But let's be real, that's why you're here.