John Hancock: What Their PR Machine Is Really Saying

Generated Title: This Is Not News. It's Content Sludge.

Email sent. Email resent.

That’s it. That’s the entire text. It flashed across some forgotten corner of the internet, a digital ghost in the machine. A failed command, a corrected error, a perfect, accidental poem about the world we’ve built. A world where soulless, automated dispatches are now what we call “information.”

I stumbled across one of these dispatches today, a so-called "instant news alert" titled John Hancock Premium Dividend Fund (NYSE:PDT) Declares Monthly Dividend of $0.08. And I swear, reading it felt exactly like that glitchy email notification: a message sent with no soul, resent with no purpose, signifying absolutely nothing.

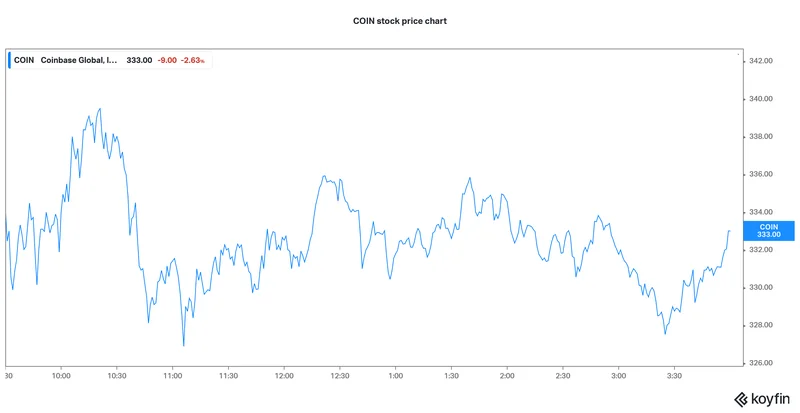

The article proudly declared it was “generated by narrative science technology.” Let’s just call it what it is: a robot wrote it. A bot was fed a few data points—a dividend of $0.0825, a 7.4% yield, some stock ticker movement—and it barfed out 500 words of the most generic, paint-by-numbers financial "reporting" I’ve ever seen.

This is the future, they tell us. Fast. Accurate. Efficient. But is it? Is a machine telling you that a company will pay its shareholders eight cents really "news"? Or is it just content sludge, poured into the cracks of the internet to fill space and harvest clicks? It’s like a vending machine that dispenses unsalted crackers—it technically provides sustenance, but nobody’s ever excited about it.

The Algorithm Will See You Now

Let’s be real. The announcement of a monthly dividend for a fund like this isn't breaking news. It's a calendar event. It’s the financial equivalent of a bus schedule. It’s predictable, it’s routine, and it sure as hell doesn’t require "narrative science technology" to report. The bot tells us the 50-day moving average is $13.36 and the 200-day is $13.01. Gripping stuff. I was on the edge of my seat.

Then we get the list of "large investors." Walled Lake Planning & Wealth Management LLC. Landscape Capital Management L.L.C. Nomura Holdings Inc. Do these even sound like real places? They sound like shell corporations from a bad spy movie. Faceless entities shuffling digital money around based on what other algorithms tell them to do. It’s a closed loop of machines talking to other machines about the movement of imaginary wealth, and we’re supposed to be impressed by it.

This is just lazy content. No, lazy isn't the right word—it's parasitic. It exists only to occupy a URL, to catch a few Google search terms, and to create the illusion of activity. They feed you these numbers, these moving averages, this 7.4% yield, and it’s supposed to mean something, but... what? What insight is a human being supposed to glean from a robot stating that a stock went up 0.8%? What decision can you possibly make from this information, other than the decision to close the tab?

The Quiet Whispers of the Sales Funnel

Here’s where the whole charade falls apart. After paragraphs of this machine-written drivel, we get to the real point. The human touch, if you can call it that. The article ends with a dramatic pivot.

“Before you consider John Hancock Premium Dividend Fund, you'll want to hear this.”

Suddenly, the tone shifts. We’re told that top-rated Wall Street analysts are “quietly whispering” about five other stocks that are much better buys. And, surprise surprise, the John Hancock fund ain’t on the list. But don’t worry, you can “View The Five Stocks Here.”

And there it is. The entire article, the "narrative science technology," the stock tickers, the dividend announcements—it was all just an elaborate, automated on-ramp to a sales funnel. Its a classic bait-and-switch. They aren’t informing you; they’re qualifying you as a lead. The robot builds the maze, and the salesman waits at the end with a block of cheese.

What does it say about our information ecosystem when the "news" is just a prelude to a sales pitch? This isn't journalism. This isn't even analysis. It’s a digital mannequin dressed up in a reporter’s trench coat, designed to lure you into a back alley where someone can sell you a watch. The "quietly whispering" analysts are probably just another algorithm, and the five stocks are whatever they’re paid to push this week.

Then again, maybe I'm the crazy one. Maybe there are people out there who find this stuff useful. But I seriously doubt it.

Just More Noise

At the end of the day, this isn't about John Hancock or dividend funds or Wall Street. It's about the relentless, soul-crushing firehose of digital noise we're all drowning in. It's about the replacement of human insight—flawed as it may be—with sterile, automated content designed not to inform, but to occupy, to redirect, and to sell. It's an information economy running on empty calories. And just like that glitchy email, it sends the message, then sends it again, hoping we'll eventually mistake repetition for importance. We shouldn't.