QQQ's Record-Breaking Surge: What's Behind the Record Run and Where Tech is Headed Next

Don't Call It a Bubble: Why QQQ's Defiance Is a Glimpse Into Our Tech-Powered Future

*

I want you to try a little thought experiment with me. Picture two screens, side-by-side. On the left, you have the news: Congress is at a standstill, the U.S. government is in its tenth day of a shutdown, and respected Wall Street titans are using words like “bubble” and “risk” with increasing frequency. The headlines are a symphony of anxiety.

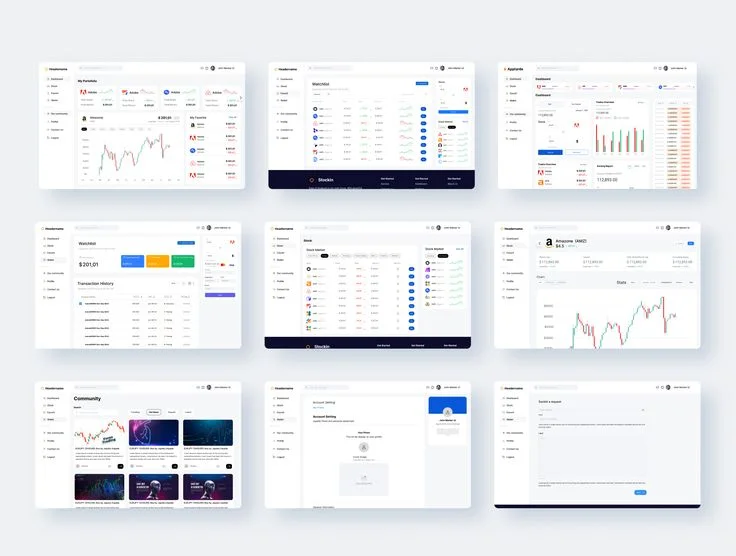

Now, look at the screen on the right. It’s a stock chart for the QQQ, the ETF that tracks the Nasdaq-100. It’s not red. It’s not even flat. It’s green, pointing sharply upward, charting a course into record-high territory. This contrast is the subject of many a Stock Market News Review: SPY, QQQ Clinch Record Highs as Government Shutdown Extends to Eighth Day.

The easy conclusion? The market has lost its mind. It’s disconnected from reality, floating on a sea of irrational exuberance. But I’m going to tell you something else. I believe what we’re seeing isn’t a delusion. It’s a clarification. This isn’t a sign of the market’s insanity; it’s a profound vote of confidence that the engine of technological progress is now more powerful than the friction of political dysfunction.

When I first saw the market hit new highs in the middle of this shutdown, I honestly just sat back in my chair and smiled. Because this is the kind of breakthrough that reminds me why I got into this field in the first place. For years, we’ve talked about a future where innovation dictates the pace of human progress. What if this is the moment the market finally agrees, pricing in a future where code matters more than congressional votes?

The Signal in the Noise

It’s easy to get lost in the noise. When legends like Ray Dalio and Paul Tudor Jones raise alarms about a potential bubble, we should absolutely listen. They’re brilliant minds who have navigated treacherous market waters for decades. We have a government shutdown matching the historical average duration, with no clear end in sight. We have consumer sentiment showing signs of wavering under inflationary pressure. This is the chaos, the static that fills our daily feeds.

But beneath that static, there’s a powerful signal humming with energy. That signal is the underlying strength of the American economy, driven by two forces: the consumer and the innovator. While Washington bickers, Wells Fargo is upgrading its GDP growth estimates for 2025 and 2026, citing incredibly resilient consumer spending. The Commerce Department’s data backs this up. People are still building, buying, and participating.

This reminds me of the late 1990s. The noise then was about “irrational exuberance” and sky-high valuations for companies that, frankly, didn’t make any money. The critics weren’t entirely wrong—a painful correction did happen. But they missed the bigger picture. They saw the bubble, but they missed the birth of the internet age. They focused on the froth, not the fundamental rewiring of society that was happening underneath. The dot-com bubble burst, but the digital revolution it heralded changed absolutely everything.

What we’re seeing now is a similar paradigm shift, but with one crucial difference. The companies leading this charge aren’t just selling dreams. They’re selling the picks and shovels—and the intelligent machinery—for a new industrial revolution.

This Time, It's Different—Really

The word “bubble” gets thrown around a lot, but it has a specific meaning. As Goldman Sachs’ Peter Oppenheimer correctly points out, bubbles typically happen when the market value of companies tied to a new technology wildly outpaces the actual cash they can generate. It’s a frenzy built on pure speculation.

That’s simply not what’s happening today. The giants at the top of the Nasdaq-100—the very companies that give the QQQ its power—are not ethereal startups with no business model. They are cash-generating fortresses with some of the strongest balance sheets the world has ever seen. Oppenheimer notes that the AI rally is supported by rock-solid fundamentals—in simpler terms, these companies are actually making enormous amounts of money from their innovations, not just promising to someday.

This isn't a bet on a hypothetical future; it's an investment in a very real, very profitable present that is building that future.

Think of it this way. The dot-com bubble was like building a thousand beautiful, empty stadiums on the promise that a fantastic new sport would one day be invented. Many of those stadiums went bankrupt. Today's AI-driven rally is like building out the global infrastructure for a sport that is already drawing Super Bowl-sized crowds every single day. The demand is proven, the players are established champions, and they’re selling tickets, merchandise, and broadcast rights at an incredible clip.

Is it possible that valuations are getting "stretched," as Oppenheimer cautions? Of course. And that’s where the responsibility comes in. We can’t let our excitement for the future blind us to the need for smart, diversified strategies. But the core premise is sound. Even a firm like DKM Wealth Management sees this, a move detailed in reports like DKM Loads Up on QQQ With 7,900 Shares Worth $4.8 Million. Their filing might suggest a shorter-term tactical play, but it’s still a multi-million-dollar bet on the undeniable momentum of right now. What does it tell you when the smart money, even for a short sprint, is running in this direction?

It tells me they hear the signal, too. The speed of this is just staggering—it means the gap between the technology we have today and the world it will create tomorrow is closing faster than we can even comprehend, and the market is desperately trying to keep up.

A Bet on Human Ingenuity

So, when you look at that QQQ chart defying the gloomy headlines, what are you really seeing? Are you seeing a number, a ticker symbol detached from reality? Or are you seeing what I see?

I see a measurement of our collective faith in progress. I see a declaration that technology, real innovation, and the fundamental human drive to build and create is becoming a more powerful economic force than political gridlock. It’s the market finally understanding that the great leaps forward don’t come from a committee vote in Washington; they come from a garage in California, a research lab in Cambridge, or a distributed team of coders collaborating across continents.

This isn’t a bubble. It's a realignment. It's the beginning of an era where the defining metric of our economic health won't be political stability, but the velocity of innovation. The question for all of us, then, is simple. Are you going to invest in the noise, or are you going to invest in the signal?