The Alaska-Hawaiian Airlines Merger: Unlocking the Future of Your Miles and Hawaii Flights

The Ghost in the Machine: Can an Algorithm Capture the Aloha Spirit?

There’s a fascinating tension playing out in the skies over the Pacific right now. On one hand, you have the cold, hard reality of a $1.9 billion corporate merger. Alaska Airlines has acquired Hawaiian Airlines. The deal is done, the papers are signed, the parent company exists. It’s a closed chapter, a settled fact of modern capitalism.

But on the other hand, a federal court just breathed new life into a lawsuit from travelers who feel they've been wronged, giving them a chance to prove the very real harm they feel. This legal challenge raises a fundamental question: Can Travelers Really Undo Alaska’s Hawaiian Airlines Takeover? And in that disconnect—between the boardroom and the boarding pass—lies a question that I find absolutely captivating. It’s not about antitrust law or stock prices. It’s about whether you can truly acquire a soul.

We’ve all seen the online chatter, the posts from long-time flyers that are tinged with a genuine sense of loss. One comment struck me with its simple, heartbreaking clarity: "the airline I loved feels like a stranger." This isn't just about a new logo on the tail fin. This is about a perceived betrayal of a relationship, a feeling that the unique, intangible quality that made Hawaiian Airlines special—the so-called "aloha spirit"—is being systematically overwritten by a new corporate operating system.

When I first read that, I honestly just sat back in my chair. It’s the kind of human-centric problem that technology and business so often fail to solve. We can merge databases, integrate loyalty programs, and optimize flight paths with stunning efficiency. But can we port a culture? Can we quantify and transfer the feeling of being welcomed into a family? That’s the real challenge here, and it's far more complex than any logistical integration.

A System Showing Signs of Rejection

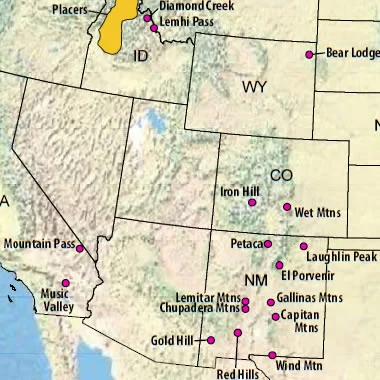

Let’s be clear: the grievances aren’t just vague feelings. They are tangible, measurable, and frustrating. The lawsuit alleges what many travelers are already experiencing firsthand: reduced competition, higher fares, and lost jobs. We’ve seen beloved non-stop routes, like Boston to Honolulu and Austin to Honolulu, simply vanish from the schedule. These weren't just lines on a map; they were vital arteries connecting distant parts of the country to the heart of the islands.

Then there's the loyalty program, the digital handshake between an airline and its most valued customers. The transition from the celebrated "Pualani Gold" status to the new "Atmos" tier has, for many, felt like a significant downgrade. We're hearing about higher mileage redemption rates and difficulties with family accounts—it’s a classic case of a system being streamlined at the expense of the user experience. This is the corporate equivalent of a biological transplant where the host body is beginning to reject the new organ. The merger might be technically complete, but the customer base—the airline’s lifeblood—is signaling an immune response.

The Ninth Circuit's ruling is the most visible symptom of this. A lower court had initially dismissed the travelers' lawsuit for "lack of standing"—in simpler terms, the plaintiffs hadn't yet provided concrete proof that they were personally harmed by the deal. But the appeals court just sent a powerful message: Go back, amend your complaint, and show us the receipts. Show us the canceled flights, the pricier tickets, the devalued miles. This isn't just a legal maneuver; it's a validation of that collective feeling of loss. It’s the system acknowledging that the pain points are real and deserve to be heard.

What we're witnessing is the friction between two fundamentally different worldviews. One sees an airline as a collection of assets: planes, routes, and market share. The other sees it as an experience, an identity, a cultural ambassador. Alaska Airlines promised this merger would mean more routes and better service, but the initial data points are painting a very different picture, and you have to wonder if the executives planning this integration truly understood what they were buying. Did they mistake the vessel for the spirit it carried?

The Necessary, Painful Evolution

Now, it’s tempting to paint this as a simple David vs. Goliath story, a beloved local brand being devoured by a corporate behemoth. But the truth, as it so often is, is far more nuanced. You don't have to dig deep to find a powerful counter-narrative: this merger wasn't a choice, it was a necessity.

Hawaiian Airlines, for all its cultural resonance, was reportedly in serious financial trouble. The airline hadn't turned a profit since 2019. The stark reality is that the alternative to this merger might not have been the status quo; it might have been bankruptcy. Liquidation. The end of Hawaiian Airlines altogether. From this perspective, Alaska Airlines isn't a predator; it's a savior, the only one willing to step in and prevent a beloved institution from disappearing entirely. It’s a sobering thought—the idea that the "stranger" people now see is the only thing keeping the airline they loved from becoming a ghost.

This situation reminds me so much of Alaska's previous acquisition of Virgin America. I remember the passion of Virgin’s fans, their love for the mood lighting, the quirky service, the sheer vibe of the airline. And I remember their profound sense of loss as it was slowly, methodically absorbed. The brand vanished, but the network and the planes were integrated into a stronger, more competitive Alaska Airlines that could better challenge giants like United, Delta, and American Airlines.

Was that a failure or a success? It depends entirely on what you value. This is the crucial test for Alaska now, and it’s a chance for them to write a different ending to the story. The challenge isn't just to keep the planes flying; it’s to prove they can be a worthy steward of a legacy—to fuse the operational efficiency of Alaska with the cultural soul of Hawaiian, creating something that is not a dilution, but a true synthesis. It's a breathtakingly difficult task, maybe one of the hardest in modern business, because it requires a level of empathy and cultural intelligence that balance sheets simply cannot measure.

The Soul Isn't on the Balance Sheet

Ultimately, this entire saga hinges on a single, profound question: What is an airline? Is it merely a transportation service, a commodity to be bought and sold? Or is it something more—a promise, an identity, a repository of memories and culture? Alaska Airlines bought the planes, the routes, and the brand name. But they inherited the legacy. They inherited the responsibility of the "aloha spirit." This lawsuit, win or lose, is a powerful reminder that the most valuable asset of all—the fierce loyalty and love of its customers—can't be acquired. It has to be earned, every single day, on every single flight.