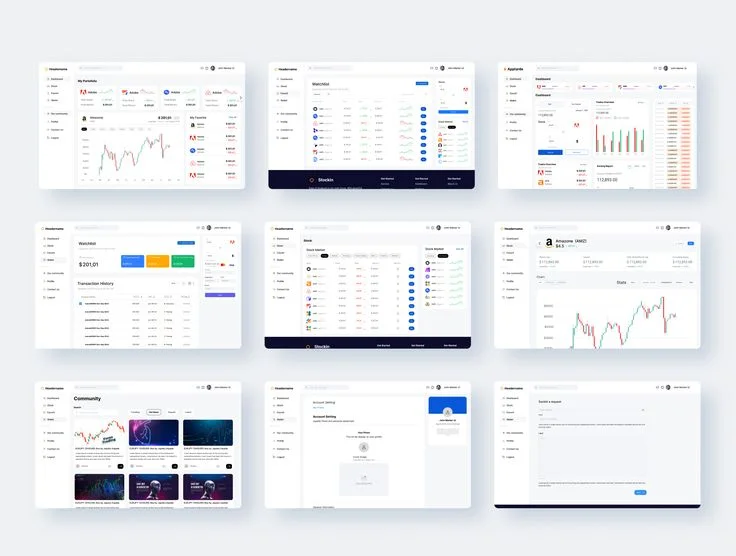

Figma Stock: Executive Sales and What We Know

Figma, the collaborative design platform, recently crossed the vaunted $1 billion annual revenue run rate. That's according to CEO Dylan Field, anyway. The market seems to be buying it, at least initially. A strong third quarter, with revenue hitting $274.2 million (beating estimates of $263.95 million), has the bulls excited. The 38% year-over-year growth is nothing to sneeze at, especially in this market. But let's dig a little deeper than the headlines.

Cracks in the Foundation?

The narrative is that Figma's AI investments—specifically Figma Make and the MCP server—are driving this growth by broadening the user base. And it sounds good, doesn't it? AI this, AI that. But what's the actual contribution of these AI features to the bottom line? Details are, conveniently, scarce. What percentage of new users are specifically drawn in by the AI capabilities, versus the core design functionality? What's the average revenue per user for AI-engaged customers compared to non-AI users? These are crucial questions that remain unanswered.

We do know Figma's net dollar retention rate for high-value customers (those generating at least $10,000 in annual recurring revenue) was 129% at the end of Q2. Impressive, sure. But that number has been decelerating for two consecutive quarters. That's a trend, and not a good one. It suggests that while Figma is still extracting more money from its existing big clients, the rate at which they're doing so is slowing. Is this simply a natural plateau after a period of hyper-growth, or is it a sign of deeper issues with customer satisfaction or competitive pressures?

Then there's the guidance. Figma is forecasting revenue of $263 million to $265 million. That represents just a 33% increase from the $198.6 million delivered a year earlier. And remember, the market punished Figma severely (a 20% stock plunge) when it offered similar guidance last quarter. Are we seeing a repeat performance in the making?

Executive Suite Exits?

Now, let's talk about insider activity. On November 5, 2025, a flurry of Figma executives sold off substantial chunks of their stock. CAO Herb Tyler, GC & Secretary Brendan Mulligan, CRO Shaunt Voskanian, CTO Kris Rasmussen, and CFO & Treasurer Praveer Melwani all cashed in. Rasmussen, the CTO, unloaded a whopping 73,738 shares, pocketing over $3.5 million. Melwani, the CFO, sold over $775,000 worth of shares.

Normally, insider selling isn't necessarily a red flag. Executives have personal financial planning to do, diversification needs, and so on. But the scale and simultaneous nature of these sales raise eyebrows. Are they simply taking profits after the stock's initial surge, or do they know something the rest of us don't? Are they losing faith in the long-term growth story? I've looked at hundreds of these filings, and this particular cluster of sales is unusual, to say the least. It feels…coordinated. Figma Executives Cash In: Massive Stock Sales Revealed!

Consider this analogy: It's like watching the captain and several senior officers quietly lowering lifeboats while assuring passengers the ship is unsinkable. It doesn't inspire confidence.

Wells Fargo lowered Figma’s price target, citing concerns about its premium valuation, the lock-up release, and the timing of pricing impacts, alongside long-term considerations about growth sustainability and new product integration. In other words, the market is starting to question whether Figma's current valuation is justified by its future prospects.

And this is the part of the report that I find genuinely puzzling: Figma's collaboration with Google to integrate AI-powered design tools. It's not inherently bad, but is it really a game-changer, or just another partnership to generate some hype? Figma delivers strong forecast as AI draws in more customers

AI is a Trend, Not a Guarantee

Figma's success hinges on more than just AI buzzwords. It needs to demonstrate sustained, profitable growth, not just flash-in-the-pan excitement. The decelerating retention rate, the tepid guidance, and the executive stock sales paint a more complex picture than the "billion-dollar revenue run rate" headline suggests.