The GameStop Phenomenon: What Its Latest Moves Signal for the Future of Investing

I want you to close your eyes for a moment. Picture the digital ticker tape of the stock market on the morning of October 3rd, 2025. It’s a sea of quiet greens and reds, the usual pre-market hum. But then, one symbol starts to pulse with an impossible energy: GME. It’s surging, flagged by the major networks as a “biggest mover,” and you can almost feel the collective intake of breath from millions of retail investors watching on their phones. Stocks making the biggest moves premarket: GameStop, USA Rare Earth, Applied Materials, Zillow and more

This isn’t just another stock rally. We’re not just watching numbers on a screen. We are witnessing a fascinating, real-time experiment in corporate evolution. This is the story of a company that stopped playing by the old rules and started listening to a new signal—the deafening roar of its own community. What’s happening with GameStop isn't about nostalgia for video game stores; it's a glimpse into the future of how companies might be built, funded, and steered in the 21st century.

The Glitch in the Old Machine

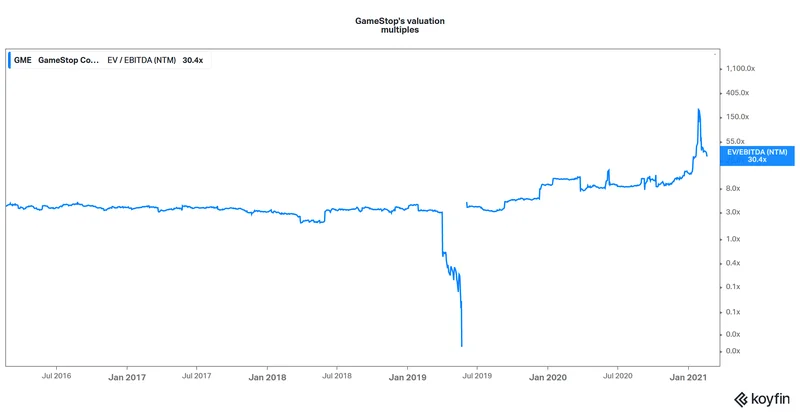

Let’s be clear: by every traditional metric, Wall Street thinks GameStop is a ghost. The consensus among analysts is a resounding "Sell," with a price target hovering around a paltry $13.50. They look at the company through a dusty old lens, seeing declining legacy software sales and a brick-and-mortar past. They run their models, check their boxes, and conclude the machine is broken.

But what if they’re using the wrong manual entirely? What if they’re trying to diagnose a combustion engine when they’re looking at a living, breathing organism that is actively rewriting its own DNA?

When I first saw the Q2 2025 balance sheet, I honestly just sat back in my chair, speechless. This "dying retailer" is sitting on nearly $8.7 billion in cash and marketable securities. It swung from a loss to a staggering $168.6 million in net income. This isn't a company on life support; it's a company that has quietly built a fortress. It's like watching a caterpillar retreat into its chrysalis, only to find out it’s been forging high-tech armor inside. The old guard sees a dying bug; I see a metamorphosis. They are fundamentally misinterpreting the data because their framework is obsolete. The question is no longer "Can GameStop survive?" The question is, "What is it becoming?"

The company's pivot isn't just about cutting costs. It's a radical refocusing on high-margin collectibles and, more profoundly, a savvy embrace of digital assets, with over half a billion dollars in Bitcoin on its books. Is this a risky, unconventional move for a retailer? Absolutely. But isn't that the entire point? Innovation doesn't come from following the well-trodden path. It comes from having the courage to leap onto a new one.

A New Corporate Language

The most brilliant part of this story isn't just the financial turnaround. It's the way GameStop's leadership, particularly Ryan Cohen, communicates with its investor base. They’re not using press releases and stuffy conference calls; they’re using the language of the internet, of the community that saved them.

Look at the recent corporate actions. An 11-for-10 stock split and a 1-for-10 warrant distribution. To a traditional analyst, these are just financial mechanisms. But to the community, they are signals. The stock split is a nod to accessibility, making shares easier for smaller investors to own. The warrants—in simpler terms, they’re long-term call options that reward shareholders for holding—are a genius move that says, "We believe in the future, and we want you to come along with us." It’s a direct incentive for long-term belief, a tool that binds the company and its supporters together. GameStop Stock (GME) Opinions on Recent Earnings and Stock Split Announcement

This creates an incredible feedback loop between the company's strategic moves and the community’s enthusiastic response which in turn provides the capital and the market stability for the company to make even bolder moves—it’s a self-reinforcing cycle of belief and execution that traditional finance has absolutely no model for. It’s a public, collaborative corporate strategy session happening on a global scale. We’ve seen this before, but not in finance. This reminds me of the early days of the open-source software movement, where a decentralized community of passionate believers came together to build something far more resilient and innovative than any single corporation could. Is GameStop pioneering the first "open-source" corporate turnaround?

Of course, this path is fraught with immense risk. Building your company on the faith of a decentralized, often chaotic, online community is like building a skyscraper on a tectonic plate. The energy is immense, but it requires incredible skill and genuine alignment to channel it constructively. The responsibility on the company's leadership isn't just to shareholders in a legal sense, but to the millions of people who have poured their hope and capital into this vision.

But what if it works? What if this becomes a new blueprint? Imagine a future where companies are no longer beholden only to a handful of institutional investors, but are in direct, constant dialogue with a massive, engaged community of supporters who help fund, guide, and champion their mission. What other "broken" companies could be resurrected this way?

The Blueprint is Being Written

Forget the "meme stock" label. It’s a lazy, dismissive term for a phenomenon that is far more profound. We are watching a case study in real-time of how value, community, and corporate identity are being radically redefined. The old guard on Wall Street doesn't understand it because you can't capture a revolution in a spreadsheet. GameStop is more than a company now; it's a movement. And it's showing us that in the networked age, a company's greatest asset may not be its factories or its patents, but the unwavering belief of its people.