POET Technologies' AI Future: Why This $75M Investment is a Game-Changer for AI

When the news broke about POET Technologies closing a massive $75 million investment (POET Technologies Closes US$75M Investment to Accelerate AI), I saw the usual flurry of headlines. The stock price surged, trading volume exploded—all the familiar metrics that get day traders excited. But honestly, that’s not what made me sit up straight in my chair. The numbers are just the echo. The real event, the thing that truly matters for the future we’re all building, is what this capital unlocks.

This isn't just a story about a successful financing round. It’s a signal flare, illuminating the next great battlefield of the AI revolution. For years, we’ve been obsessed with the raw processing power of GPUs, cramming more and more transistors onto silicon. We built bigger and bigger digital brains. But we’ve been quietly ignoring the colossal traffic jam forming between them. This investment is a bet, and a huge one at that, on solving the single biggest bottleneck holding back the true potential of artificial intelligence: the speed of communication.

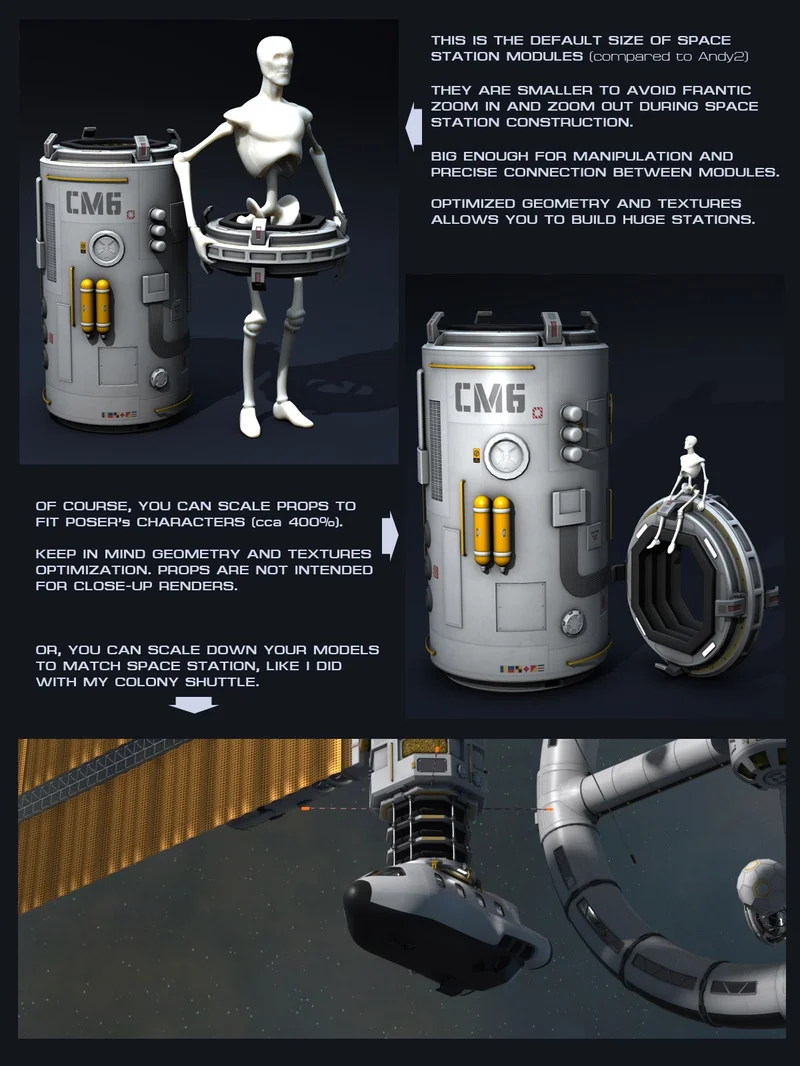

When I first read the details of POET's Optical Interposer platform, it reminded me why I got into this field in the first place. It’s a technology of profound elegance. The platform allows for the seamless integration of electronic and photonic devices into a single chip—in simpler terms, it’s about turning electrical data into light and back again, right where the computing happens, at blistering speeds. Imagine trying to coordinate a symphony orchestra where every musician has to communicate by sending handwritten notes. That’s the state of our current AI data centers. POET is essentially giving every musician a direct, instantaneous telepathic link.

This is the kind of fundamental breakthrough that doesn't just make things faster; it changes the very architecture of what's possible. So, while the market celebrates a 23% stock jump, I’m looking at the blueprint for the nervous system of the next generation of AI. How many revolutionary AI models are currently sitting on whiteboards, deemed impossible not because of a lack of processing power, but because we simply can't move the data around fast enough?

A War Chest for the Next Frontier

Let’s be clear about what seventy-five million dollars really means for a company like POET. This isn’t just about keeping the lights on or funding another research cycle. When CEO Dr. Suresh Venkatesan called it part of a "war chest of over $150 million" (POET Technologies Secures $75 Million Investment to Boost AI Connectivity), he chose his words carefully. A war chest isn’t for defense; it’s for conquest. It's for targeted acquisitions, for aggressively scaling up R&D, and for accelerating their light source business into a dominant market position.

This is the moment a promising technology company transitions from a fascinating concept into a commercial juggernaut. It’s the difference between inventing the steam engine and getting the funding to lay the transcontinental railroad. The core invention was already there, but the capital is what reshapes the entire landscape. With this kind of funding and no significant debt, POET can now dictate the pace, acquire key complementary technologies, and accelerate their roadmap in a way that just wasn't possible a month ago—it’s a complete paradigm shift from a promising R&D firm to a potential market-shaping force.

Of course, with this kind of power comes immense responsibility. Enabling AI systems to communicate at the speed of light will accelerate their development in ways we can't fully predict. It forces us to ask not just "how fast can we go?" but "where are we going so fast?" This is the ethical tightrope every pioneering technology walks, and it’s one we have to walk with our eyes wide open. But what truly excites me is the potential for good. Imagine AI-driven medical research where data from millions of sources can be analyzed in near-real time, or climate models that run with unprecedented fidelity because the data-flow bottleneck has been shattered. This is the future this investment is funding.

The End of the Copper Age

For decades, the rhythm of progress has been dictated by Moore's Law—the doubling of transistors on a microchip every two years. We’re now hitting the physical limits of that paradigm. But what if we’ve been looking in the wrong place? What if the next great leap isn’t about cramming more onto the chip, but about fundamentally changing how chips talk to each other?

This is where I see the real story. POET’s technology isn’t an incremental improvement; it’s a foundational shift from electrons to photons. It’s the beginning of the end for the copper wires that have served as the data highways inside our machines for half a century. Light is faster, more efficient, and generates less heat. It is, in every meaningful way, a better medium for data. This investment is the market finally waking up to that fact.

Some analysts, like the AI-driven "Spark" from TipRanks, might look at POET’s past financial performance and assign it a "Neutral" rating. They see the negative P/E ratio and the history of R&D spending. But this is a classic case of looking in the rearview mirror to predict the road ahead. They are analyzing the caterpillar, not the butterfly that is about to emerge from the chrysalis. What good is a historical financial metric when a company has just been handed the keys to an entirely new kingdom? The question is no longer about past performance; it’s about future dominance in a market that is growing exponentially.

This single, massive cash infusion from a savvy institutional investor says more than a thousand analyst reports. It says the quiet part out loud: the future of computing is built on light, and the companies laying down that fiber-optic foundation today will be the giants of tomorrow.

The Speed of Light is the New Moore's Law

So, let's forget the stock charts for a moment and appreciate what’s really happening here. We are witnessing a pivotal transition. For fifty years, progress was measured by the density of silicon. For the next fifty, I believe it will be measured by the speed of light. This $75 million isn’t just an investment in a company; it’s an investment in a new paradigm. It’s the fuel for an engine that will power the next wave of innovation, and we’re all about to feel the acceleration. The real story isn't about the money that went into POET; it's about the ideas that will now come out.