The hype around crypto ETFs has reached a fever pitch, and the CoinShares Altcoins ETF (DIME) is the latest shiny object attracting investor attention. With $3.08 million in flows since its October launch, DIME promises a regulated gateway to the vast altcoin universe—a tempting prospect, considering these alternative cryptocurrencies now represent over 40% of the digital asset market. But before you jump in, let's dissect the data and see if this ETF is a smart diversification play or a potential portfolio landmine.

DIME offers equal-weighted exposure to 10 Layer 1 blockchain protocols, including Solana, Avalanche, and Cardano. The fund achieves this by investing in *other* exchange-traded products that hold these altcoins, rather than directly purchasing the underlying assets. This layered approach is designed to navigate the regulatory minefield. (It's a bit like investing in a fund that invests in other funds—fees on fees, anyone?). CoinShares is even waiving the 0.95% management fee for assets up to $1 billion until September 2026, which is, admittedly, a smart move to attract early adopters. DIME has gained 5.5% over the past week, according to ETF Database data.

But here's where the data starts to raise some eyebrows. CoinShares themselves emphasize that altcoins are more akin to early-stage tech startups than traditional currencies. Most launch through initial offerings, raising capital much like venture capital rounds. This isn't necessarily a bad thing, but it does fundamentally alter the risk profile. We're not talking about established assets; we're talking about bets on unproven technologies.

Altcoin ETFs: Diversification or Just Diversified Risk?

The Allure of Diversification (and the Danger of Dead Coins)

The appeal of altcoins lies in their potential to offer diversification beyond Bitcoin and Ethereum. They open doors to decentralized finance (DeFi), blockchain gaming, and cross-chain infrastructure. Total value locked (TVL), active wallet growth, and developer activity are touted as key metrics for evaluating these projects. These indicators should reveal whether a project is building real utility or is merely fueled by speculation. The problem? Those metrics are easily gamed, and even the most promising projects can quickly fade into obscurity.

And this is the part of the report that I find genuinely puzzling. CoinShares' own research highlights that Blockspot.io lists over 17,000 "dead coins"—failed cryptocurrency projects that lost value or were abandoned—as of September 2025. 17,000! That’s not a typo. Altcoins are a minefield. The ETF structure, with its regulatory oversight, *should* help investors avoid scams and failures, but it doesn’t eliminate the fundamental risk of investing in unproven technologies. It just adds another layer of fees and complexity.

The fund tracks the CoinShares-Compass Crypto Altcoin Index, which rebalances quarterly and selects constituents based on liquidity, trading history, and custodial support. Current holdings include Polkadot, Near Protocol, Cosmos, Aptos, SUI, Toncoin, and SEI. But even with these safeguards, the inherent volatility of the altcoin market remains. A quarterly rebalance can only do so much to mitigate the risk of a project collapsing.

Altcoin ETFs: Mainstream or Just a Greater Fool?

The ETF Boom: A Sign of Maturity or Market Top?

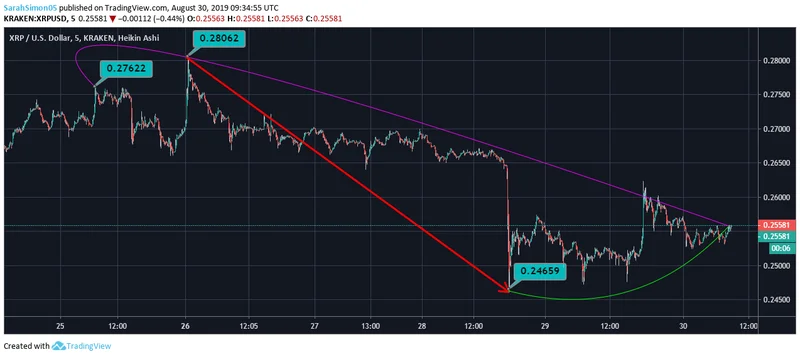

It's worth considering the broader context of the crypto ETF market. Global crypto ETFs drew a record $5.95 billion in inflows in the week ending October 4, 2025, as Bitcoin surged to new all-time highs. The U.S. led the charge with $5 billion in inflows, followed by Switzerland and Germany.

Global crypto ETFs attract record $5.95 billion as bitcoin scales new highs This influx of capital is undoubtedly driving the altcoin market as well. But is it sustainable? Or are we seeing a classic "greater fool" scenario play out, where early investors profit while later entrants get left holding the bag?

The SEC's move towards generic listing standards for commodity-based exchange-traded products has undoubtedly accelerated the approval process for crypto ETFs. Grayscale's Digital Large Cap Fund, holding Bitcoin, Ethereum, XRP, Solana, and Cardano, was the first to take advantage of this streamlined route. Now, asset managers are aggressively filing for spot ETFs tied to altcoins like Solana and XRP. But even with these regulatory tailwinds, the fundamental question remains: are these assets truly ready for mainstream investment?

And while the UK’s decision to allow crypto ETNs within Stocks and Shares ISAs offers retail investors tax advantages, it’s only a temporary measure (until April 6, 2026). It seems like everyone wants a piece of the crypto pie.

A Fool and His Money?

Ultimately, the CoinShares Altcoins ETF is a high-risk, high-reward proposition. It offers a regulated way to access the altcoin market, but it doesn't eliminate the inherent risks of investing in unproven technologies. The 0.95% management fee (waived temporarily) adds another layer of cost, and the layered ETF structure raises questions about efficiency. So, is it the future of crypto diversification? Maybe. But investors should proceed with caution, do their own research, and be prepared to lose their shirt.

The Hype Doesn't Match the Risk