XRP Price Analysis: Price Prediction and What the Latest News Reveals

The narrative surrounding Ripple and its native token, XRP, has always been one of grand ambition. It’s a story of a modern-day disruptor aiming to rewire the very plumbing of global finance, a system dominated for half a century by the incumbent SWIFT network. We’re told this is a battle for the future of cross-border payments, pitting Ripple’s blockchain efficiency against SWIFT’s entrenched, near-monopolistic scale.

Commentators and analysts love this kind of binary conflict. It’s easy to frame and easy to sell. On one side, you have Ripple, with its promise of near-instant, low-cost settlements, already securing partnerships with firms like SBI Remit and Pyypl. On the other, you have SWIFT, the financial titan connecting over 11,000 institutions, now belatedly entering the blockchain arena with its own project. The speculative fervor reaches a crescendo when you see reports like Here’s How High The XRP Price Would Be With The Market Cap Of Bitcoin, with hypothetical calculations suggesting the `price of xrp` could hit $40.68 if it were to attain the market capitalization of Bitcoin. It’s a compelling story.

The problem is, while the market is fixated on this long-term, almost philosophical war, the immediate data on the screen is telling a completely different tale. And it’s not a bullish one.

The Incumbent's Gambit

Before we dissect the current market structure, it’s crucial to understand the strategic positioning here. SWIFT isn’t trying to out-innovate Ripple on pure technology. It can’t. Ripple’s On-Demand Liquidity network is purpose-built for speed and efficiency. Instead, SWIFT is playing the long game, leveraging its single greatest asset: its network.

SWIFT’s plan is essentially a defensive moat built with blockchain bricks. By partnering with Consensys to create an interoperable ledger, it’s offering its 11,000 members a path to modernization without forcing them to abandon their legacy systems. This is a brilliant, if cautious, corporate strategy. It’s not about embracing a single volatile asset like the `xrp crypto price` reflects; it’s about creating a flexible platform for various regulated stablecoins and tokenized assets. This is the kind of low-risk, incremental change that appeals to risk-averse banking compliance departments.

To put it in another context, this isn't a race between a sports car and a freight train. It’s a battle over logistics. Ripple is the sleek, high-speed delivery drone that can get a package from A to B faster than anyone. SWIFT is the entire existing global postal service, with every post office, truck, and mail carrier already on its payroll. Now, that postal service is starting to experiment with its own drones. It may be clunky and late, but its distribution network is already built. The question is whether Ripple can build out its own network faster than SWIFT can modernize its existing one.

While that strategic battle plays out in corporate boardrooms and development labs, the actual market for XRP is facing severe, quantifiable headwinds that the grand narrative conveniently overlooks.

A Look Under the Hood at the Numbers

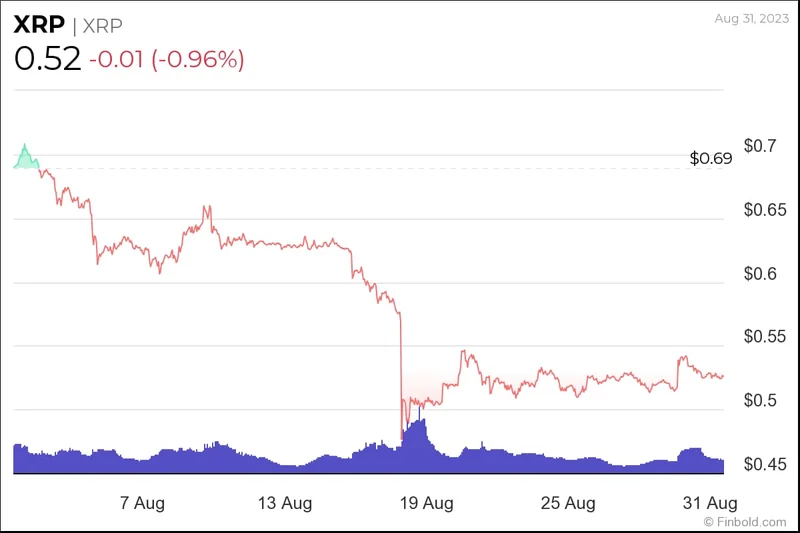

I’ve analyzed countless flow reports, and sustained selling of this magnitude from large holders, while not a death knell, is a significant headwind that the bullish narrative often conveniently ignores. While the world debates SWIFT, the on-chain data for XRP paints a picture of significant distribution. According to CryptoQuant analysis, large holders—or "whales"—have been offloading their positions at a steady clip. This has led to headlines asking, XRP whales dump $50M per day: Will it crash the price? We’re seeing outflows from whale wallets averaging around $50 million per day—to be more exact, the 30-day moving average of their outflow is hovering right at that mark.

This isn't just a blip. It correlates directly with a surge in XRP supply on centralized exchanges, a classic leading indicator of intent to sell. The red candle on the daily chart deepens, pushing the `xrp usd` ticker further below the key $2.80 level, a number that traders have been watching with clenched jaws.

This selling pressure is being reflected in the derivatives market as well. Futures Open Interest (OI), which measures the value of outstanding contracts, has fallen from a high of $9.09 billion to $8.47 billion in just a few days. A steady decline in OI alongside falling price suggests traders are closing out their long positions, losing conviction in a potential recovery. It’s a sign of capital fleeing the asset.

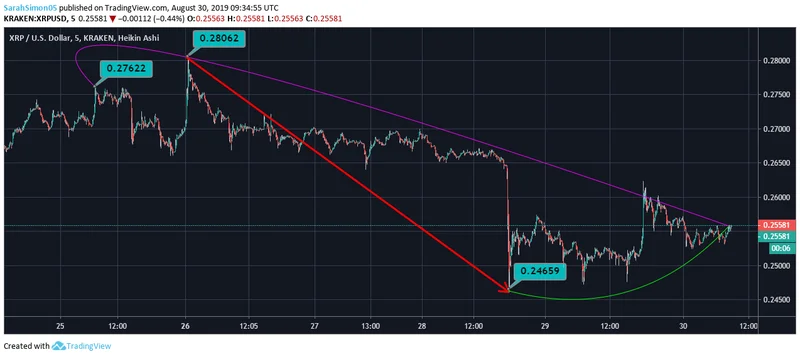

Then there’s the technical picture, which is frankly grim. Veteran trader Peter Brandt has flagged a descending triangle pattern on the XRP/USD daily chart, a formation that typically resolves to the downside. The pattern’s support sits at $2.75. A clean break below that level projects a measured move down towards $2.20, a potential 22% decline from current levels. This drop below the 100-day Exponential Moving Average (currently at $2.85) is a classic bearish signal for technicians, suggesting the medium-term trend has flipped in favor of the sellers.

What does all this mean? It means that while the company, Ripple, is making strategic moves in places like Bahrain and Dubai, the asset, XRP, is under immense pressure from its largest holders. The hope for a spot XRP ETF approval might provide a temporary spike, but the data suggests whales could use that very liquidity event as their final exit point.

The Narrative and the Numbers Are at War

Ultimately, we have two competing realities. The first is the long-term, narrative-driven reality where Ripple challenges a global financial behemoth, carves out a niche in remittances, and pushes the `xrp price today` toward speculative highs. It’s a story of potential, partnerships, and paradigm shifts.

The second reality is the one reflected in the cold, hard numbers of the present. It’s a reality of $50 million in daily selling pressure from the asset's largest investors, waning conviction in the futures market, and a bearish chart pattern that points to significant further downside. The narrative is a promise about tomorrow. The numbers are a warning about today. And in my experience, when the story and the data are in direct conflict, the data usually wins.