Crypto News: November's ETF Delay and What We Know

Okay, buckle up, folks. November’s shaping up to be a wild ride in the crypto world, and I’m here to tell you why this isn’t just another month – it’s a potential turning point. We're seeing a confluence of events, from ETF shenanigans to security scares, all while the underlying tech continues its relentless march forward. So, what's the real story? Let's dive in.

The ETF Express: A Shortcut to the Future?

First off, let’s talk about these crypto ETFs. Four of them slipped onto the market this week through what some are calling a “procedural shortcut,” bypassing the usual SEC song and dance. Two from Canary Capital, one from Bitwise, and one from Grayscale. Now, Bloomberg Intelligence ETF analyst James Seyffart thinks we’ll see a flood of these next month, government shutdown or not. But here’s the kicker: some of these filings haven’t even received SEC feedback. It’s like the Wild West all over again, isn't it? According to CoinDesk, November Could Be the New October for U.S. Crypto ETFs After Shutdown Delays SEC Decisions due to potential government shutdown delays.

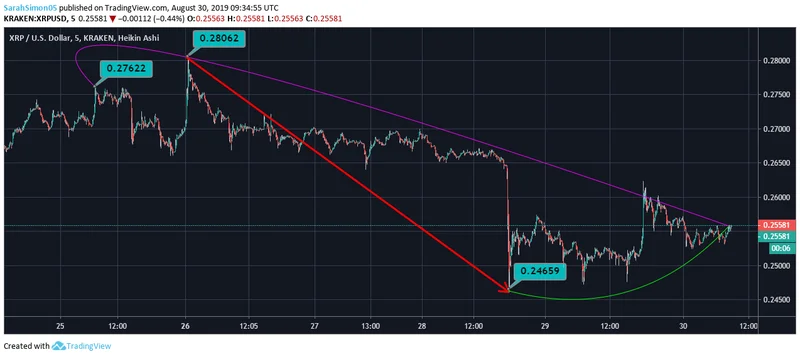

And it doesn't stop there. Fidelity tossed in an updated S-1 for their spot Solana ETF, and Canary Capital’s doing the same for an XRP ETF. If the SEC doesn't throw a wrench in the gears, we could see the first XRP fund as early as November 13th, 2025. Imagine that! An XRP ETF... Who would have thought?

But hold on a second. CryptoQuant CEO Ki Young Ju is throwing some shade, saying Bitcoin’s recent slump is because ETFs and MicroStrategy aren’t bringing in enough new demand. He even suggests the four-year cycle might be fading. Is he right? Are we entering a new era where the old rules don't apply? It makes you wonder if we are nearing the end of the beginning.

Security and Transparency: A Balancing Act

Now, let’s pivot to something a little less rosy: Balancer protocol’s potential exploit. A cool $70.9 million in assets moved to a new wallet on November 3rd, 2025. That’s a gut punch, no matter how you slice it. Transferred tokens include 6,850 OSETH, 6,590 WETH, and 4,260 wstETH. It's a stark reminder that security in the DeFi space is still a work in progress, isn’t it?

On the flip side, we have Gate publishing their latest quarterly reserve report. They’re boasting total reserves of $11.676 billion and an overall reserve ratio of 124% as of November 3rd, 2025. They’re holding 24,833 BTC against user balances of 18,537 BTC, with an excess reserve ratio of 33.96%. Their ETH reserves are 419,096 ETH versus 332,802 ETH in user balances, a 25.93% excess ratio. And they’ve got $1.58 billion in USDT reserves, compared to $1.33 billion in user holdings.

Transparency is key, folks. Gate’s report is a good sign, a step in the right direction. But Balancer’s situation reminds us that we can't let our guard down. It's like building a skyscraper – you need both solid foundations and robust safety measures.

It makes me wonder, how can we better incentivize security audits and responsible protocol development? What if we saw a "DeFi insurance" system emerge, backed by these over-collateralized reserves?

The Big Picture: A Maturing Ecosystem

We are seeing sector rotations in the crypto market, reflecting the fast-paced evolution of the space. The AI sector took a hit, while Dash, ICP, and zkSync saw impressive gains. It's a reminder that this market is anything but monolithic.

And let's not forget the elephant in the room: the political landscape. President Trump claims he doesn’t know CZ, days after issuing him a presidential pardon. He says he “heard” Zhao’s prosecution was part of a “Biden witch hunt,” adding that “the war on crypto is over.” Whether you agree with Trump or not, it's undeniable that crypto is now firmly in the political arena.

Remember the AWS outage back in October? Some of crypto’s biggest names, like Coinbase and Robinhood, went down. That was a wake-up call. We need more decentralized infrastructure, more redundancy. We need to build a system that can withstand shocks, both technical and political.

What does this mean for us? It means the crypto space is maturing, evolving, and becoming more resilient. The "November Revolution" isn't just about ETFs or exploits; it's about the entire ecosystem taking another step forward.