Dodge Chrysler Jeep: The Carvana Connection and What It Means

Title: Decoding the Carvana Paradox: From Used-Car King to CDJR Franchisee?

Carvana, the online used-car platform that once seemed poised to disrupt the entire automotive retail industry, is now dabbling in an unexpected arena: new car franchises, specifically Chrysler-Dodge-Jeep-Ram (CDJR) dealerships. This pivot raises a critical question: is this a strategic evolution, or a sign of deeper structural problems?

The Curious Case of Carvana's New Direction

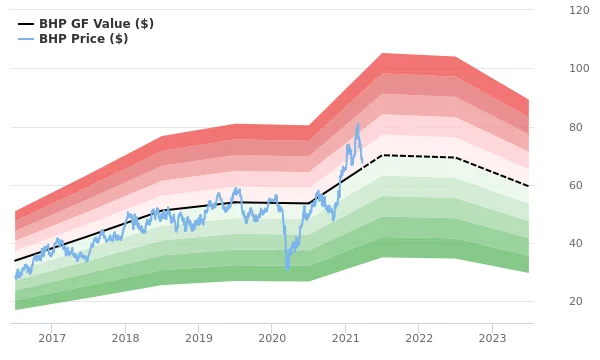

The numbers paint a clear picture of Carvana's trajectory. After a meteoric rise fueled by pandemic-era demand and aggressive expansion, the company faced a brutal reckoning. Bloated inventory, logistical nightmares, and regulatory scrutiny sent its valuation plummeting. Yet, against all odds, Carvana has shown signs of recovery (a "grift for the ages," as one investment group put it, though perhaps a bit harsh). This recovery coincides with an intriguing move: the acquisition of two CDJR franchises, one in Arizona and another in Texas.

Why CDJR? The explanation offered – that these dealerships were simply "available" – feels incomplete. Carvana characterized the Arizona purchase as "a small test in a single market." A test of what, exactly? And why double down with a second location in Dallas? Carvana’s getting into the new-car game after its biggest analog rival, CarMax, has gotten out. CarMax once operated several new-vehicle franchises but has since bailed on that front entirely. What's Carvana seeing that CarMax missed? Carvana Is Slowly Becoming a Chrysler-Dodge-Jeep-Ram Chain for Some Reason

Digging Deeper: Inventory, Regulation, and the Stellantis Factor

One plausible explanation lies in Carvana's past struggles. The company's rapid growth exposed critical weaknesses in its infrastructure, particularly in title processing and regulatory compliance. Losing its dealer license in Michigan and settling a lawsuit in Connecticut over registration delays are significant black marks. A physical presence, with established processes for handling paperwork, could mitigate these risks.

Another factor could be inventory. Carvana's used-car model relies on a constant flow of vehicles. Establishing relationships with manufacturers through franchises provides a more stable and predictable supply. Moreover, the choice of CDJR might not be coincidental. Stellantis, the parent company of Chrysler, Dodge, Jeep, and Ram, has faced its own set of challenges in the current market. This might make CDJR franchises more readily available, and potentially more amenable to Carvana's unconventional approach.

Nino Sita, general manager at Lindsay Dodge Chrysler Jeep Ram, has helped steer the Virginia-based dealership to the number one CPO ranking in the region and number seven nationally, while also driving the store’s new car sales up 196% year-over-year. Lindsay Dodge Chrysler Jeep Ram also has an aggressive vehicle acquisition strategy, which includes incentivizing salespeople. ❝ “The first time you buy a car is a salesperson, I pay you $200. The second car of the month is ($300). Third car of the month is $400. Fourth car is $500, and the last car is $600 for the rest of the ones you buy through that,” said the GM.

What's the real strategy here? Is Carvana trying to become a hybrid online/offline retailer? Or is it simply diversifying its revenue streams to hedge against future disruptions in the used-car market? Details on Carvana's long-term vision remain scarce, but the acquisitions suggest a significant shift in strategy.

Carvana's Gamble: A Calculated Risk?

Carvana's move into new car franchises is either a stroke of genius, or a sign of desperation. The company is betting that it can leverage its online platform and data analytics to improve the efficiency and customer experience of traditional dealerships. But it also faces the challenge of integrating two very different business models.

The most important question is: will Carvana succeed in this new venture? Or will it become another cautionary tale of a tech company overreaching its capabilities? (I've seen this pattern play out countless times in other sectors). The answer, as always, will depend on execution and adaptability.

A Premature Victory Lap?

Carvana's pivot into new car franchises isn't necessarily a sign of long-term stability. It's a calculated risk, and the jury is still very much out.