Open Stock: What's the Deal?

Opendoor's Q3 Earnings: More Like "Closed-Door" Policy on Reality?

So, Opendoor's Q3 earnings are dropping today, Nov 6th. Big whoop. Analysts are "expecting" -$0.08 EPS on $849.60 mil in revenue. Okay, cool story. What I really want to know is: who are these "analysts," and are they being held hostage by Opendoor's PR team?

The "Solid Track Record" Scam

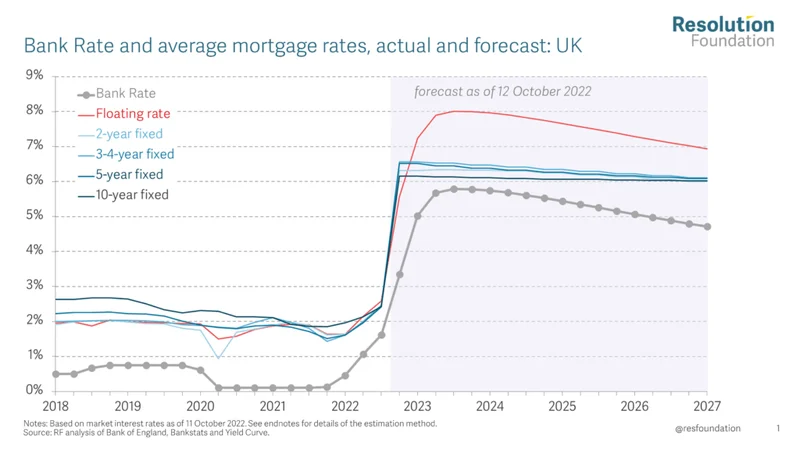

Ten consecutive quarters of beating earnings? Give me a break. That's like saying a casino has a "solid track record" of taking people's money. It's built into the damn system. And now they're trying to spin the narrative about navigating a "tough housing market"? Please. High mortgage rates and weak demand ain't exactly breaking news. It's called reality.

They're projecting revenue between $800 million and $875 million. Contribution margin of 2.8% to 3.3%. Adjusted EBITDA…wait for it…between a negative $28 million and $21 million. So, losing money is the new winning? Got it. Makes perfect sense.

And this "Cash Plus" thing? Upfront cash and potential future profits? Sounds like some kind of timeshare pitch. I bet the fine print is longer than a CVS receipt. Who in their right mind thinks this is a good deal for the seller?

Meme Stock Mania: The Blind Leading the Blind

Oh, and let's not forget the meme stock surge. Up 292% over the past 52 weeks, 899% over the past six months. Because, offcourse, fundamentals don't matter anymore. It's all about the "bargain find," right? A bargain find that's still somehow managing to lose tens of millions of dollars.

And they're streaming the earnings presentation on Robinhood? Seriously? That's like hosting an AA meeting at a brewery. They're practically begging for another pump-and-dump scheme.

The stock is trading at a "cheap valuation" because its price-to-sales ratio is lower than the industry average. That's the best argument they can come up with? So, if I sell a turd for less than the average price of gold, it's suddenly a good investment? I don't think so.

The Million-Dollar Question (That No One's Asking)

Here's the real question: who is actually benefiting from all of this? Is it the homeowners getting "hassle-free" offers? Is it the investors piling into a meme stock based on hype? Or is it just the executives at Opendoor, cashing in on stock options while the whole thing slowly implodes?

I'm just saying, the whole thing stinks.