Mortgage Rates Hit a New Low: What This Means for Homeowners & The Refinance Question

I’ve been staring at the numbers all morning. The average rate for a 30-year fixed mortgage is hovering at 6.156%. For many people, that number feels like a wall. You plug it into a `mortgage calculator`, and the dream of a new home flickers, the monthly payment blinking back like a warning light on a dashboard. We’re told this is the reality, the product of the Fed, inflation, and a dozen other colossal forces. We obsess over every basis point, every tick up or down in `today mortgage interest rates`.

But what if we’re all staring at the wrong problem?

When I look at this data—the conventional loans, the jumbo loans, the `VA mortgage rates` all dancing to their own slightly different tunes—I don’t just see a financial report. I see a bug report for a piece of legacy software. An old, complicated, and deeply inefficient operating system that we’re all forced to run. And we’ve become so fixated on tweaking the settings, on chasing a slightly better `mortgage rate today`, that we’ve forgotten to ask the most important question of all: Shouldn’t we just write new code?

The Old, Unstable Operating System

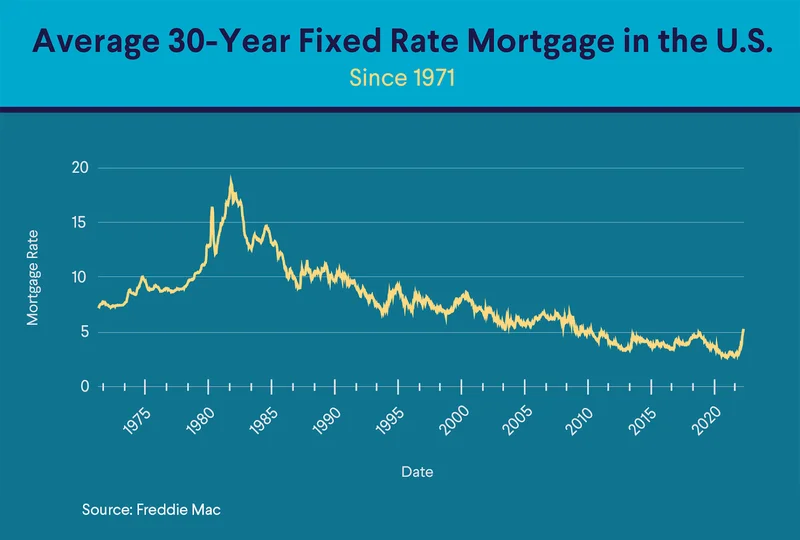

Let’s be honest. The mechanism that determines `mortgage interest rates` is a beautiful mess. It’s a chaotic system where the Federal Reserve makes a move, and the market… well, the market sort of does its own thing. The Fed cut its key rate, and everyone expected mortgage rates to gracefully follow suit. They didn’t, not really. They wobbled, dipped, and then shot right back up, tethered not just to the Fed but to a web of other inputs.

Think about the sheer number of variables at play: the national debt, the global demand for U.S. bonds, lender profit margins, and the buying and selling of mortgage-backed securities—in simpler terms, this is where loans are bundled up and sold like trading cards to investors, and investor confidence in that market has a huge say in your rate. It’s this incredibly complex, almost unpredictable dance of dozens of powerful forces, and we, the end-users, are just sitting on the sidelines hoping the final output is a number we can live with for the next 30 years.

This isn’t a streamlined, elegant system designed for the 21st century. It’s a patchwork of fixes and additions bolted onto a framework that’s decades old. It’s like trying to run a modern virtual reality app on a computer from 1995. You can try to optimize the memory and tweak the settings, but you’re still fundamentally limited by the creaking architecture underneath. Are we truly innovating when our best advice for homebuyers is to build a top-tier credit score and get their DTI ratio below 36%? That’s not a solution; it’s a workaround. It’s learning the cheat codes for a game that was badly designed from the start.

So, what happens when we stop asking, "What are `current mortgage rates`?" and start asking, "Why is this system built this way in the first place?"

Escaping the Golden Handcuffs

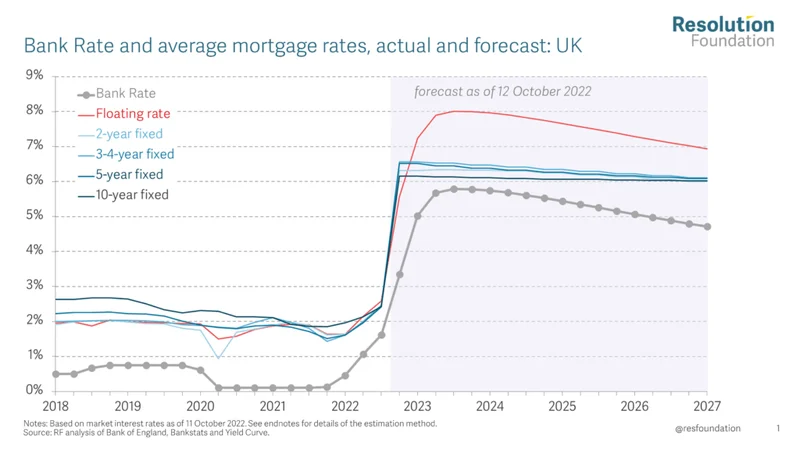

The most fascinating part of this whole situation isn't even the math; it's the psychology. The report mentions the "golden handcuffs," the phenomenon of people feeling trapped in their current homes because they have a once-in-a-lifetime 2% or 3% interest rate. This is a perfect illustration of how our human brains get stuck on an anchor point, unable to see the bigger picture.

When I first read about this on a mass scale, I honestly just sat back in my chair, speechless. We have designed a system where a positive financial decision from the past actively prevents people from making the right life decisions for their future—moving for a new job, getting a bigger place for a growing family, or downsizing after the kids leave. It’s a system that optimizes for inertia.

This obsession with the low rates of 2021 is a historical trap. It’s like people in 1910 complaining about the rising cost of hay for their horses, completely oblivious to the fact that the automobile was about to rewrite the entire concept of transportation. We’re all fighting to get back to a historical anomaly, a brief moment when the government flooded the system with capital to stave off a pandemic-induced collapse, instead of designing a system that’s resilient and equitable in the first place.

And this is where we have to have a moment of real talk. A system that relies so heavily on a handful of metrics like credit scores—which are often lagging indicators of financial health and can be influenced by systemic biases—risks becoming an engine for inequality. It creates a feedback loop where those with existing financial advantages get the best `home mortgage rates`, further cementing their position, while others are left paying a premium. Is this really the best we can do? Can we design a system that looks at a person’s potential, not just their past?

It's Time for a System Upgrade

Forget the fractional point changes in `30 year mortgage rates`. That’s the old conversation. The real, exciting, and profoundly necessary conversation is about building a new financial architecture for homeownership. What if we used technology not just to shave a few dollars off a monthly payment, but to fundamentally reinvent the entire process?

Imagine a system built on a transparent, distributed ledger where title insurance becomes obsolete because ownership is verifiable and immutable. Imagine AI models that create a far more holistic, real-time picture of an applicant's financial health and future earning potential, moving beyond the rigid, and often inequitable, FICO score. Think about new models of ownership—fractional, co-operative, rent-to-own—natively supported by a financial system designed for flexibility, not 30-year rigidity.

The tools are here. The dissatisfaction with the current system is palpable. All that’s missing is the collective will to stop patching the old OS and start designing the new one. The goal shouldn't be to find the `best mortgage rates today`; it should be to create a world where that question feels laughably obsolete.