Mortgage Rates Are Falling: What the New 30-Year Rate Means and If You Should Even Bother Refinancing

So, the headlines are screaming that mortgage rates just hit a 13-month low. I can almost hear the popping of champagne corks from the boardrooms at Freddie Mac. They’re trotting out their chief economist, Sam Khater, to tell us all that rates "continued to trend down."

Give me a break.

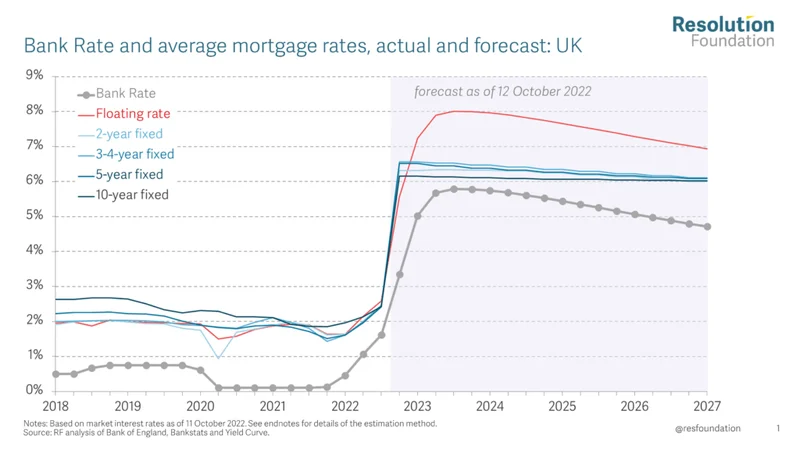

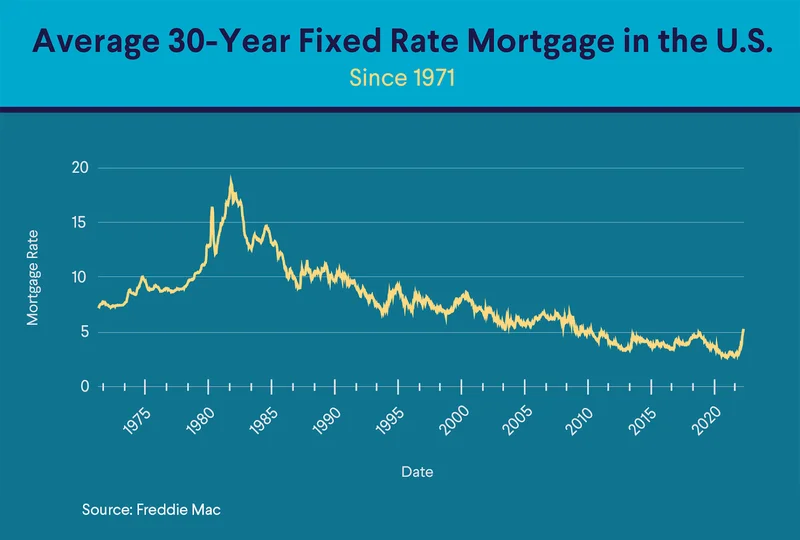

This is like celebrating because the guy who’s been punching you in the face for a year decided to switch to just slapping you. Are we supposed to send a thank-you note? The 30-year fixed rate is at 6.19%. Yes, that’s better than the 7%-plus we were staring down at the start of the year. But let’s zoom out for a second, shall we? On January 7, 2021, that same rate was 2.65%. Two-point-six-five percent.

We’re not "trending down." We’re just falling slightly slower from a catastrophic height. This isn’t a recovery; it’s a PR campaign to make a terrible situation feel palatable. And the fact that refinancings are making up more than half of all mortgage activity tells the real story. People aren't rushing out to buy new homes in this glorious new rate environment. They're desperately trying to rejigger the numbers on the homes they already have so they don't go broke. That's not a sign of a healthy market; it's a sign of a population under financial siege.

The Numbers They Don't Want You to See

Okay, let's play their game for a minute. They want you to look at the shiny objects. The S&P "flash" index shows a "rebound." The stock market is up. Oil prices are whatever. Fine. Now let’s look at the numbers that measure how actual human beings feel about their lives.

The University of Michigan’s Consumer Sentiment Survey didn't just dip; it cratered. It fell for the third straight month, down to 53.6. For context, a year ago it was 70.5. That’s not a statistical wobble; that’s a vote of no confidence in the entire system. People are scared. They feel poor, they feel uncertain, and no slick report from Freddie Mac is going to change that.

This is the great disconnect. The spreadsheet jockeys in their ivory towers see a PMI tick up a few points and declare victory, while regular people are looking at their grocery bills and wondering if they can afford to keep the lights on. It's a tale of two economies. No, that's not right. It's a tale of one economy, and a bunch of analysts who are paid to pretend it's a different one.

And isn't it just a little too convenient that the September new home sales report is being withheld because of a government shutdown? The one piece of data that could give us a real, unfiltered look at housing demand is suddenly… unavailable. I’m sure it’s just a coincidence. Offcourse it is. They want you to focus on the mortgage rate today and not ask too many questions about why nobody can afford to actually use it. What are they hiding in that report? Is the market so dead that releasing the numbers would shatter this fragile "good news" narrative they’re trying to build?

So, What's the Real Play Here?

Here’s my take. The "experts" are all over the map. Fannie Mae thinks 30 year mortgage rates will slowly drift down to 5.9% by the end of 2026. The Mortgage Bankers Association thinks they’ll just… stay at 6.4%. It’s a complete crapshoot. They’re just guessing, the same way you and I are.

The real game here is psychological. It’s about resetting our expectations. They hit us with 7% and 8% rates to create shock and awe. Now, they let it fall back to 6.2% and expect us to feel relief and gratitude. The goal is to make 6% feel like the new 3%. It’s a classic negotiation tactic: start with an absurdly high number so the final, still-terrible number feels like a compromise.

And it’s working on some people. But I’m not buying it. The economy is showing deep, systemic cracks. Business confidence, according to S&P's own economist, is in the gutter because of boneheaded policies and tanking exports. The CNN Fear & Greed Index is still firmly in "Fear" territory. This isn't a soft landing. This is turbulence, and the pilots are telling us to stay calm while they quietly read the emergency manual. Then again, maybe I'm the crazy one here. Maybe 6% interest really is the new American Dream.

Are We Supposed to Be Grateful for This?

Let's be brutally honest. This isn't a win. This is managed decline. The entire financial establishment is trying to condition an entire generation to accept a permanently more expensive future. The goalposts for what constitutes "affordable" housing or a "good" mortgage rate have been dragged so far down the field that we can barely see them anymore. They're not fixing the problem; they're just trying to get us to stop complaining about it. This slight dip in interest rates isn't a life raft. It's just a slightly smaller anchor.