Dominion Energy's Dividend: What You Need to Know

Dominion Energy's Dividend: A Steady Ship in a Renewable Storm?

Dominion Energy—it's a name you might associate with your monthly bill, but lately, it's been making waves in the investment world too. The big question everyone's asking: Is their dividend, currently sitting at $0.6675, a safe harbor in the choppy seas of the energy market, or a siren song leading investors to the rocks?

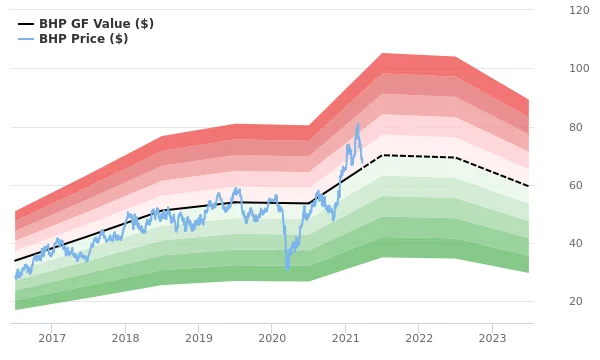

The immediate picture? A dividend yield of 4.5%, which, let's be honest, is pretty standard fare. Nothing to write home about, but not exactly a red flag either. The concern, however, lies beneath the surface. Dominion Energy's payout ratio—the proportion of earnings they're handing out as dividends—is looking a little… hefty. And free cash flows? Not exactly gushing. This raises a critical question: Can they actually sustain this? It's like trying to keep a fountain running on a nearly empty well.

But here’s where it gets interesting. Analysts are projecting a 31.2% jump in EPS (earnings per share) next year. If that pans out, the payout ratio could ease into a much more comfortable zone around 66%. Suddenly, that fountain starts looking a bit more sustainable. The question is: Can we really trust those projections?

The Winds of Change: Renewable Energy and Dominion's Future

Dominion Energy isn't just about dividends; they're diving headfirst into the deep end of renewable energy. Their Coastal Virginia Offshore Wind project, a massive undertaking, is still on track to deliver power in early 2026. But then we have the Charybdis.

This is where things get a little bumpy. The Charybdis is Dominion's wind turbine installation vessel (WTIV)—a critical piece of the puzzle. And, well, it's been facing delays. CEO Robert Blue didn't mince words: “I am extremely disappointed that Charybdis has again not met expectations… we failed to deliver regarding Charybdis.” Ouch. (Dominion Energy Confirms Commissioning Delays on WTIV Charybdis)

Now, before you write off the whole project, let's put this in perspective. The Charybdis is the first American-made, Jones Act-compliant WTIV. It's a prototype, really. There are going to be growing pains. Think of it like the early days of the automobile—lots of sputtering engines and roadside repairs. But those early cars paved the way for the reliable machines we have today. The Charybdis, despite its challenges, is a crucial step in building a domestic offshore wind industry.

The good news is they are working through the issues. Over 4,000 inspections have been done on its electrical systems, and a majority of the initial 200 problems have been addressed. Dominion still believes owning the vessel gives them a strategic advantage.

And let's not forget the progress being made elsewhere. All the monopiles have been installed, the transition pieces are nearly done, and the substations are going in. Despite the Charybdis headaches, the overall project is moving forward.

But what does this mean for Dominion's dividend in the long run? Well, the move toward renewable energy is a double-edged sword. It requires massive upfront investments, which can strain current earnings and, yes, potentially put pressure on that dividend. But, in the long term, renewable energy offers stability and growth potential as the world transitions to cleaner power sources. It's a gamble, sure, but one that could pay off big time.

Dominion is also working to alleviate energy burdens for those struggling to pay their bills. Partnering with the Piedmont Agency on Aging, they’re reaching out to senior citizens, offering assistance programs and energy-saving tips. In 2024 alone, they provided $18.3 million in assistance to over 66,000 customers. (Dominion Energy and Piedmont Agency on Aging Share Resources, Assistance for Local Seniors) It's not just about profits; it's about people.

Is This Dividend a Diamond in the Rough?

The question isn't just about the numbers; it's about the vision. Dominion Energy is betting big on renewable energy, and that bet comes with risks and rewards. The Charybdis delays are a stark reminder that innovation isn't always smooth sailing.

So, is Dominion Energy a good dividend stock? It depends on your risk tolerance. If you're looking for a rock-solid, guaranteed income stream, this might not be it. The dividend history has been bumpy, with cuts in the past. But if you're willing to ride the wave of the energy transition, Dominion Energy could be a rewarding investment.

When I look at Dominion, I don't just see a utility company; I see a company trying to reinvent itself. It's a company grappling with the challenges of building a cleaner, more sustainable future. And that's a future worth investing in.