PayPal's New Ad Platform: A First Look and the Market's Reaction

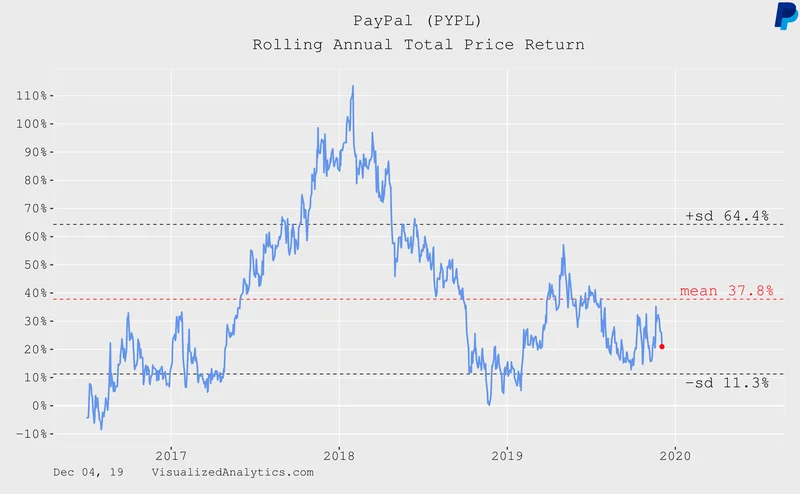

PayPal is a company adrift. For years, the fintech behemoth has been searching for a narrative to replace its slowing core payments business, a victim of its own success and the relentless commoditization of online transactions. The market, starved for a coherent growth story, has reacted with predictable enthusiasm to two recent announcements, sending the stock up on what appears to be a renewed sense of direction. The first was a holiday promotion offering 5% cash back on Buy Now, Pay Later (BNPL) purchases. The second, and far more significant, was the unveiling of an advertising platform for its small business clients.

The market saw two positive data points and reacted accordingly, a reaction captured by headlines like PayPal stock rises after unveiling Ads Manager for small businesses. I see two fundamentally different signals—one is a short-term tactical maneuver, the other a long-term strategic gamble. They reveal a company fighting a war on two fronts: one for immediate transaction volume and another for its very soul. The critical question isn’t whether these moves are good, but whether they are coherent.

The Long-Term Bet: Unlocking the Data Vault

Let’s first address the genuinely interesting development: the PayPal Ads Manager. Set for a 2026 launch, this platform aims to allow the tens of millions of small and medium-sized businesses (SMBs) in its ecosystem to create their own retail media networks. In essence, PayPal is offering to turn every small online merchant into a miniature Amazon, capable of monetizing its own site traffic by displaying ads. The hook isn't just the access, but the data. PayPal is leveraging its 25-year history of transaction data—actual, verified purchasing behavior—to target these ads.

This is, without a doubt, the most logical and potentially transformative move the company has proposed in years. For two decades, PayPal has been sitting on one of the richest, most valuable, and most underutilized data sets on the planet. Its data isn't based on what you browse, "like," or search for; it’s a direct ledger of what you actually buy. This is the holy grail of advertising. It’s like the difference between knowing someone looked at a car dealership's website and knowing they just made a down payment on a new sedan. One is intent; the other is a fact.

I've looked at hundreds of corporate strategies, and this particular pivot is fascinating because it’s an attempt to monetize an existing, deeply embedded asset rather than invent something new from scratch. The retail media industry is a multi-billion dollar space (projected to be well over $100 billion), and this move is a direct attempt to democratize it. But execution is everything. Will SMBs, who are notoriously time-poor and tech-averse, really take the time to install an SDK and manage ad preferences, no matter how simple PayPal makes it? And more importantly, can PayPal thread the needle of serving ads without degrading the clean, efficient checkout experience that was its original claim to fame?

The potential is enormous. If PayPal pulls this off, it transforms its business model from a low-margin transaction processor into a high-margin data and advertising powerhouse. But the road from a press release in 2024 to a fully adopted platform in 2026 is littered with potential failures. What’s the real adoption rate they’re modeling for this to be a success? And how will they manage the inevitable privacy concerns that come with weaponizing two decades of consumer purchase history? The answers to those questions will determine if this is PayPal’s AWS moment or its Zune.

The Short-Term Stimulus: A Costly Bid for Relevancy

Juxtapose that ambitious, long-term vision with the other piece of news that buoyed the stock: offering 5% cash back on BNPL purchases through the end of the year. On the day of the announcement, the stock jumped over 3%—to be more exact, 3.13%—prompting many to ask, “PayPal Stock Is Rising Monday: What's Going On?”—but this feels like a sugar high. This isn’t strategy; it’s a promotion. It’s a classic, brute-force tactic to drive volume in a hyper-competitive space.

Let’s be clear: 5% is a significant margin haircut. This program is not designed to be profitable on its own. It's a loss-leader, a marketing expense explicitly designed to acquire or retain users in the crowded BNPL arena, where PayPal is fighting off aggressive players like Affirm and Klarna. The company cited a survey that 60% of shoppers report increased financial stress, positioning this as a tool to help consumers. That’s the marketing spin. The analytical reality is that PayPal is paying customers to use its service over a competitor's during the most critical retail quarter of the year.

My analysis suggests this is purely a defensive move. It’s about maintaining market share and ensuring the PayPal button remains the default choice for installment payments. But what does it say about the underlying health of their BNPL product if they have to subsidize its use so heavily? Does this create long-term, loyal users, or does it simply attract transient, price-sensitive consumers who will flock to the next best offer on January 1st?

This is the core discrepancy in PayPal’s current narrative. The Ads Manager is an elegant, asset-leveraging play for the future. The BNPL cash-back offer is a clunky, expensive tool to prop up the present. One is about building a new, high-margin revenue stream. The other is about spending heavily to protect an existing, lower-margin one. Seeing the market react with similar enthusiasm to both announcements is a perfect example of short-term thinking. One is an architectural blueprint for a new skyscraper; the other is a fresh coat of paint on a load-bearing wall that’s showing cracks.

A Tale of Two PayPals

Ultimately, we are looking at a company with a split personality. The forward-looking PayPal understands its future isn't in processing payments but in leveraging the data that flows through its pipes. That PayPal is smart, strategic, and playing a long game. The other PayPal, the one running the day-to-day business, is locked in a brutal street fight, forced to spend heavily just to keep its place in line. The Ads Manager is the story investors should be watching. The BNPL promotion is just noise—a costly, necessary distraction to keep the lights on while the real work of reinvention happens behind the scenes. The success or failure of the company won't be determined by holiday shopping volume, but by whether it can successfully build a refinery for the crude oil it's been sitting on for 25 years.