Market Chaos vs. Phony 'Confident' Investors: What's Really Happening and Why Everyone's Lying

So I’m reading this Fidelity study, and I had to check the date to make sure it wasn’t an Onion article from 2021. It’s not. It’s from this year, 2025. And it says nearly half of the new crop of investors—we’re talking people with five years or less in the game—see a market dip as a "buying opportunity."

A "buying opportunity."

Let that sink in. While European markets are twitching this morning over some U.S. inflation data and Siemens Healthineers is having a good day, there’s a whole generation of traders whose entire strategy is apparently based on a meme stock subreddit from three years ago. Forty-eight percent of them plan to actively seek out "higher-growth stocks." Let's call that what it is: they're chasing lottery tickets with corporate logos.

Give me a break.

Scar Tissue, Meet the 30-Second Guru

The Ghosts in the Machine

I guess I shouldn’t be surprised. These are the kids who missed the real horror shows. For them, 2008 is a chapter in a history textbook, not the year they watched their parents’ 401(k)s get vaporized. They didn't feel that 57% drop in the S&P 500 in their gut. They saw the COVID crash in March 2020 as a V-shaped bounce on a chart, a thrilling little roller coaster ride, not the fastest-ever gut-punch into a bear market that had seasoned pros sweating through their suits.

The Fidelity study lays out the battle lines perfectly. You have the tenured investors, the ones with 10+ years of scar tissue. Thirty-five percent of them are actively lowering their risk tolerance. They prioritize limiting losses. They know the taste of ash in their mouths.

And then you have the New Guard. The ones who are, and I quote, "significantly more familiar with non-traditional assets like crypto." And offcourse, they are. A staggering 72% of them, versus just 35% of the old-timers. More than a third of these new investors are making decisions based on what they see on social media. It ain't about "historical performance" for them; it's about whatever some influencer with a rented Lamborghini is screaming about in a 30-second video.

The study has this polite little category for investors who are "more influenced by general market sentiment, news, and social media." You know what they call them? "Unsuccessful." The report itself is telling you the game is rigged against these people, but they’re lining up to play anyway.

The Gamified Lie: Your Spare Change vs. a Slaughterbot

A Slaughterhouse, Not a Casino

This is just a recipe for disaster. No, "disaster" is too clean. It's a slaughterhouse, and the new investors are the cattle, happily marching toward the door because they heard there’s free grass inside.

And who’s running the slaughterhouse? It’s not even the old guys in suits anymore. It’s the algorithms. I dug into some academic papers on this. Algorithmic Trading, or AT, does this neat little trick: it reduces price volatility on a micro-second basis, making everything look smooth and stable. But it also sucks the depth out of the market. The papers call it a "liquidity demander."

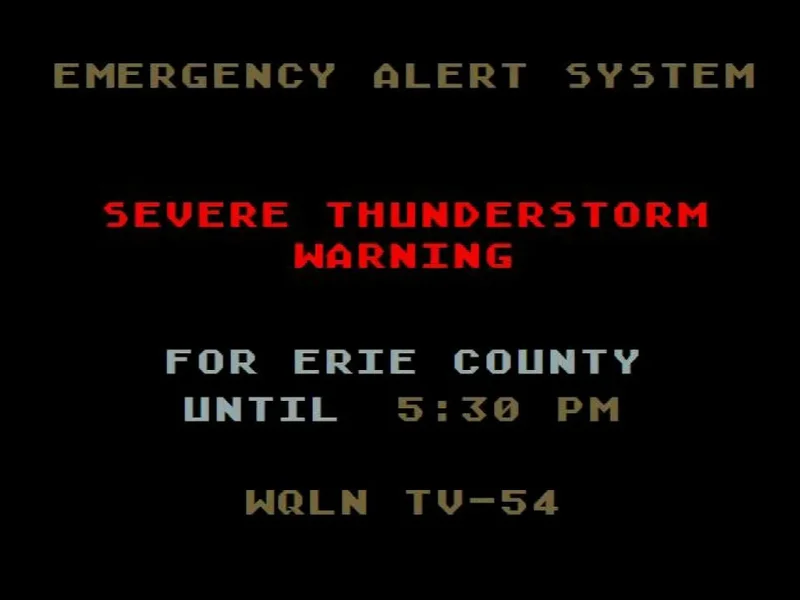

Here’s my translation: The bots aren't there to provide a safety net. They're there to scalp pennies a million times a second. When a real panic hits—the kind driven by a new trade war, or a natural disaster like Katrina that knocked 5% off the S&P, or another pandemic—those algorithms don't buy the dip. They turn off. Or worse, they accelerate the selling. They are liquidity demanders. They suck the very air out of the room, leaving the social media gurus and their followers to suffocate.

The whole system is designed to chew up this fresh meat, and yet...

It's infuriating. I can't even buy a new coffee maker without being bombarded by ads for apps that want to turn my spare change into fractional shares of some EV company that’s never turned a profit. Everything is "gamified" and "democratized," which is just slick PR-speak for "packaged for consumption by the unsuspecting." We've created a generation of market participants who think risk is a setting in a video game.

Why This "Revolution" is Just a Rerun

Same Fear, Different Fonts

The funny thing is, the underlying emotions are timeless. The study talks about fear and greed. That’s it. That’s the whole story, forever and always. It’s what drove the Tulip Mania in the 1600s and it’s what’s driving someone to dump their paycheck into a crypto coin named after a dog today. The technology changes, the platforms are slicker, but the raw, dumb, human impulse is exactly the same.

The old guard knows this. They’re cautious because they’ve been burned by their own greed or punished by their own fear. The new guard has only experienced the greed part of the equation. They’re standing on a beach, cheering and running toward the horizon because the water has suddenly pulled way, way out, revealing all sorts of shiny shells. The veterans are the ones running for the hills, because they know what a tide that goes out that fast is called.

It's a tsunami.

Then again, who am I to talk? Maybe they'll all get rich and I'm just the old guy yelling at a cloud. Maybe this time is different.

But history says it never is. The market is a patient predator, and it always, always gets fed. Right now, it’s just watching a particularly confident meal walk right up to its cage.

Same Circus, New Clowns

At the end of the day, it doesn't matter if you're getting your tips from the Wall Street Journal or a TikTok dance. The market is a machine that runs on emotion, and it's being operated by machines that have none. These new investors aren't changing the game. They're just the newest, most enthusiastic source of fuel for the fire.

Reference article source: